A Case for Proven Technology

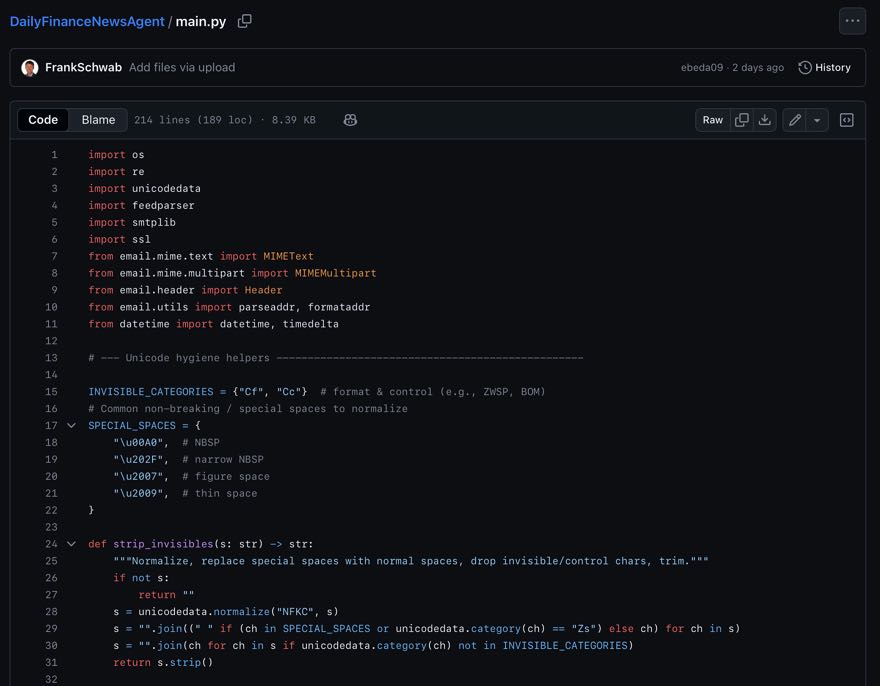

I make use of a highly efficient and convenient MAC application to manage my personal website/blog (see FrankSchwab.de). Recently, I discovered that this application is no longer under active development. Further research revealed that it ("Fishbeam Goldfish") was a solo project. After 19 years, the developer behind this user-friendly tool moved on to join a mid-sized IT firm.

This brought to mind a €20 million project at Deutsche Bank, where a team was building a new lending platform. They chose an application development platform supported by only 20 people globally. A €20 million project relying on 20 individuals. Given the scale of Deutsche Bank and the project, this was untenable, forcing us to stop it. The risk of losing future support was simply way too high.

While technology can be a key differentiator in banking, adopting the latest unproven tech, tools, or platforms can be a trap. I have frequently witnessed once-cutting-edge legacy systems, now interconnected in complex webs, accumulating substantial technical debt. This must be avoided.

Crucial factors like the number of users and the level of support needed - how many developers are backing the platform, and the stability of the provider behind a technology - must be thoroughly assessed.

From my experience in banking IT, I’ve found that innovation—whether it's exceptional user experiences or cutting-edge, real-time digital products—can flourish even when leveraging proven technology.

Published in SundayThoughts, strategy, technology, innovation, legacy, all on 22.09.2024 7:30 Uhr.