Frank Schwab

I help navigate digital transformation

The Fundamentals of Stablecoins

Bridging Volatility with Stability in Digital Finance

Executive Summary

Stablecoins are a pivotal innovation, bridging crypto volatility with fiat stability, offering efficiency, cost reduction, and financial inclusion. However, their design vulnerabilities, from de-pegging to security exploits and systemic risks, demand robust oversight. Lessons from past failures emphasize the need for transparent, liquid, and independently audited reserves. The future of stablecoins hinges on balancing innovation with evolving regulatory frameworks. International cooperation is vital for a coherent, reliable, and globally interoperable ecosystem. Their long-term success depends on consistent stability, regulatory compliance, and public trust, solidifying their role in the digital economy.

I. Defining Stablecoins in the Digital Economy

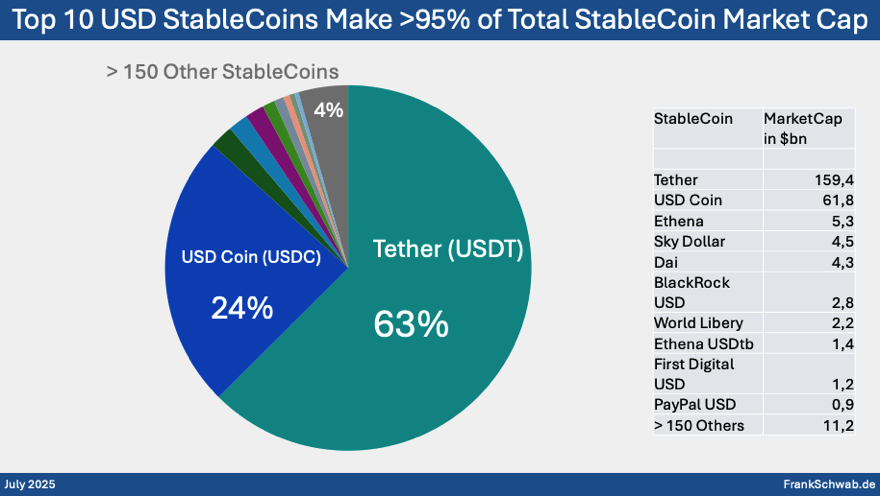

Stablecoins are a crucial class of cryptocurrency designed to minimize the price volatility common to digital assets like Bitcoin. They achieve this by maintaining a fixed "peg" to a stable external asset, most often a fiat currency such as the U.S. Dollar, but also commodities or other cryptocurrencies. This stability addresses the significant price fluctuations that limit traditional cryptocurrencies' utility as a reliable medium of exchange or store of value. Stablecoins combine blockchain advantages like decentralization and peer-to-peer transfers with the stability of conventional assets. Their market capitalization exceeds $250 billion, primarily pegged to the U.S. dollar, facilitating efficient transactions, acting as an inflation hedge, and bridging crypto with traditional finance. A core tension exists between crypto's decentralized promise and stablecoins' need for stability, which often introduces centralization or relies on fragile algorithmic mechanisms. The market's preference for centralized fiat-backed stablecoins like Tether (USDT) and USD Coin (USDC) over algorithmic ones highlights that perceived stability currently outweighs pure decentralization for many users.

IV. Inherent Risks and Vulnerabilities within the Stablecoin Ecosystem

Stablecoins face significant risks impacting users and financial systems.

A. De-pegging Events and Reserve Opacity

The primary risk is failing to maintain the peg. The collapse of algorithmic TerraUSD in 2022, which lost over $45 billion in value, starkly demonstrated the fragility of uncollateralized designs. Even collateralized stablecoins like USD Coin (USDC) experienced temporary de-pegging during the 2023 U.S. banking turmoil due to reserve exposure. A persistent challenge is the lack of transparent, real-time, and independently audited reserve information, which can erode confidence and trigger "bank run" dynamics.

B. Security Vulnerabilities

Blockchain environments are susceptible to smart contract exploits (e.g., reentrancy bugs), flash loan attacks that manipulate markets, and user-centric attacks like phishing, rug pulls, and fake tokens.

C. Systemic Risks and Contagion

Stablecoins' growing integration into DeFi and traditional finance introduces systemic risks. A major stablecoin failure could trigger cascading liquidations in DeFi or cause significant losses for financial institutions, leading to broader instability.

D. Illicit Activities

The pseudonymity of public blockchains and historical lack of robust KYC/AML standards raise concerns about stablecoins' use for illicit activities like money laundering and terrorism financing.

II. The Mechanics of Stability: Classifying Stablecoin Architectures

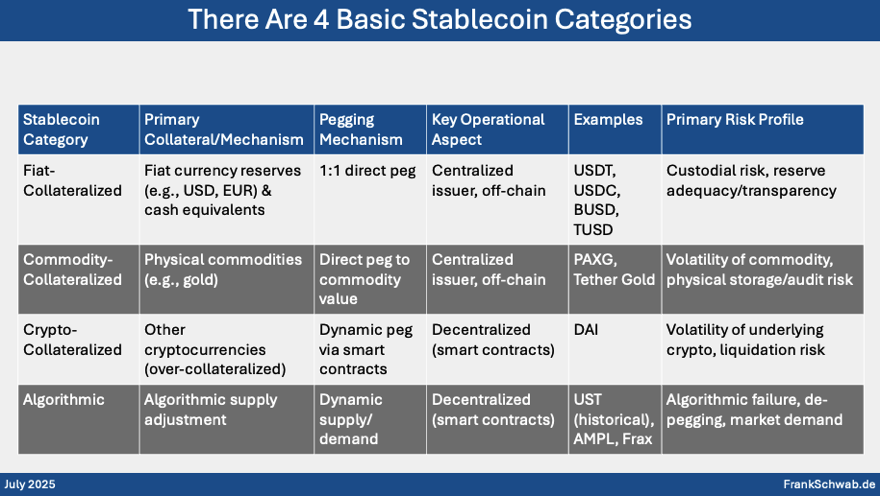

Stablecoins employ various models to maintain their price peg, differing in collateral structure, operation, and risk.

A. Fiat-Collateralized Stablecoins

These are the most common, maintaining a one-to-one peg with fiat currencies, primarily the U.S. Dollar. A centralized issuer holds equivalent fiat currency or highly liquid cash equivalents (e.g., U.S. Treasury bills) in reserve for each stablecoin issued. Examples include Tether (USDT) and USD Coin (USDC). Transparency and independent audits of reserves are crucial for trust.

B. Commodity-Collateralized Stablecoins

These stablecoins peg their value to physical commodities, typically gold. The issuer holds reserves of the commodity, adjusting them to maintain the peg. Examples like Pax Gold (PAXG) offer digital exposure to real-world assets without physical storage.

C. Crypto-Collateralized Stablecoins

Backed by other cryptocurrencies, these stablecoins use "over-collateralization" to absorb price drops in the volatile underlying assets, ensuring the stablecoin can always be redeemed at its pegged value. Smart contracts automate collateral management and trigger liquidations if collateral value falls too low. Dai (DAI) is a prominent example.

D. Algorithmic Stablecoins

These stablecoins generally do not rely on traditional reserves. Instead, sophisticated algorithms and smart contracts dynamically adjust the stablecoin's supply to maintain its peg. When the price falls, supply is reduced; when it rises, new tokens are minted. Models include rebasing (e.g., Ampleforth), seigniorage (e.g., TerraUSD/UST), and fractional (e.g., Frax). The catastrophic collapse of TerraUSD in 2022 demonstrated the extreme fragility of uncollateralized algorithmic models, particularly under market stress, shifting market and regulatory focus away from them. The design of stablecoins involves a "trilemma" of stability, decentralization, and capital efficiency, with trade-offs inherent in each type.

III. Transformative Applications and Advantages of Stablecoins

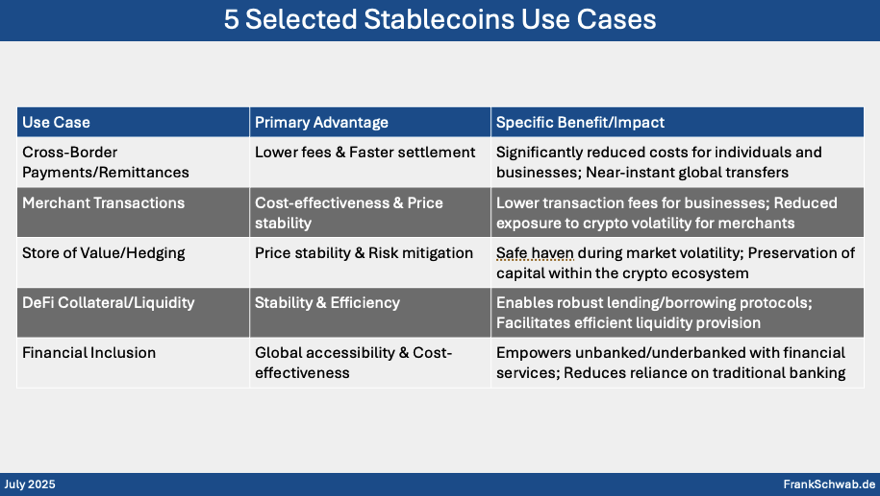

Stablecoins offer significant advantages, transforming global finance.

A. Facilitating Efficient Transactions and Payments

Stablecoins significantly reduce transaction costs and accelerate settlement times compared to traditional banking. They enable direct, peer-to-peer transfers, bypassing intermediaries and their fees. For instance, cross-border remittances can cost less than $0.01, versus over $12 on conventional rails. Transactions are near-instantaneous and operate 24/7, enhancing global accessibility, especially for unbanked populations.

B. Role as a Stable Store of Value and Hedging Tool

In volatile cryptocurrency markets, stablecoins act as a "safe haven," allowing investors to preserve value and reduce exposure to price swings without converting to fiat.

C. Integration within Decentralized Finance (DeFi)

Stablecoins are essential to DeFi, serving as collateral in lending/borrowing protocols and as stable mediums for staking and liquidity provision, mitigating volatility within these applications.

D. Promoting Financial Inclusion

By offering cost-effective, accessible, and borderless financial services, stablecoins can advance financial inclusion for unbanked and underbanked populations, enabling them to save, pay, and access credit more efficiently.

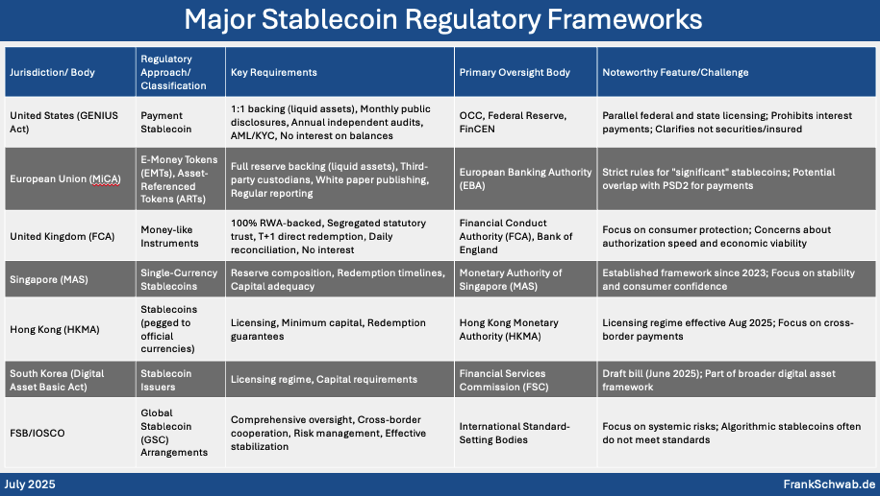

V. The Evolving Global Regulatory Landscape for Stablecoins

The rapid growth of stablecoins has prompted an intense global regulatory response.

A. United States Regulatory Initiatives

The U.S. is moving towards a federal framework, with efforts like the GENIUS Act. Proposed rules mandate 1:1 backing with liquid assets, monthly public disclosures, annual independent audits, and strict AML/KYC compliance. Issuers cannot pay interest or imply federal insurance.

B. European Union Regulations (MiCA)

MiCA is a comprehensive framework categorizing stablecoins as "E-Money Tokens" (EMTs) or "Asset-Referenced Tokens" (ARTs). Issuers must maintain full liquid reserves, publish white papers, and undergo regular reporting. "Significant" stablecoins face stricter supervision.

C. United Kingdom Regulatory Approach

The UK's FCA aims to regulate "qualifying stablecoins" as money-like instruments. Proposals include 100% Real-World Asset (RWA)-backing, segregated statutory trusts, and a direct right to T+1 redemption. Concerns exist regarding slow authorization and economic viability.

D. Developments in Asia

Asian jurisdictions like Singapore, Japan, Hong Kong, and South Korea are rapidly advancing stablecoin frameworks, focusing on reserve composition, redemption, capital adequacy, and licensing.

E. International Standards and Cooperation

Bodies like the Financial Stability Board (FSB) are working on unified standards for "global stablecoins," emphasizing comprehensive oversight, risk management, and effective stabilization mechanisms, noting that purely algorithmic stablecoins often fall short.

F. Impact of Regulatory Uncertainty

The varied global regulatory landscape presents both opportunities and challenges. While regulation aims to enhance protection and confidence, it can also inhibit innovation or impose heavy compliance burdens. Divergent approaches could reshape global finance, highlighting the need for harmonization to support responsible innovation and manage systemic risks.

#stablecoins #cryptocurrencies

© Frank Schwab 2025