No AI without HI

Artificial intelligence (AI) is often viewed as a separate entity, but its roots are firmly planted in human intelligence (HI). AI is a creation of human ingenuity, designed and built by humans. We develop the algorithms, train the models on data we collect and curate, and interpret the results. Even the most advanced AI needs human oversight to ensure accuracy and prevent unintended consequences.

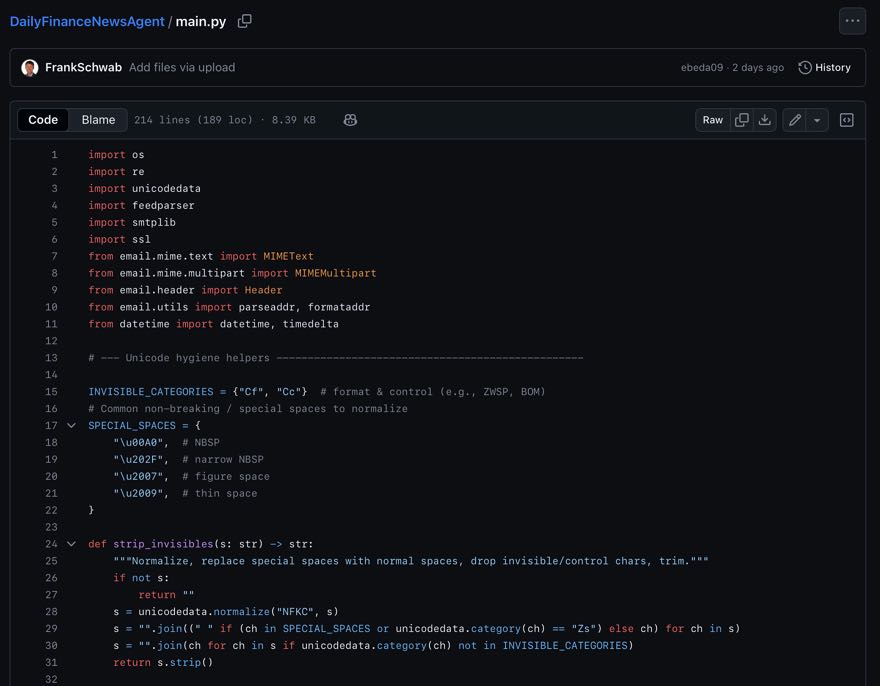

And this is exactly my experience. By now, I'm using AI tools daily, even to write this very text! It feels like we're at the beginning of a massive learning curve, akin to the early days of automobiles. Just like those first cars in 1900, AI is still a bit clunky and requires effort to master. Honestly, it doesn't necessarily save me time yet, but the quality of my output is undeniably enhanced. My writing, especially in English, has definitely improved thanks to AI assistance.

Furthermore, our very definition of "intelligence" is based on human capabilities. AI seeks to replicate these, like learning and problem-solving, but within a framework that we define. It's a reflection of our own cognition, a tool to understand ourselves better.

While AI may surpass human abilities in specific areas, it's crucial to remember it remains a tool, an extension of our own intelligence. Its true potential lies in collaboration, where humans and AI work together, each leveraging their strengths for mutual benefit. AI is not a replacement for human intelligence, but a powerful complement to it.

#AI #HI

#SundayThoughts

FrankSchwab.de

Published in SundayThoughts, AI, ArtInt, all on 12.01.2025 8:30 Uhr.