Charles Schwab's journey reflects a complex interplay of growth, acquisition, digital transformation, and operational challenges. While the company has achieved significant milestones in expanding its client base and enhancing its digital capabilities, it must continue to address operational efficiency to fully realize its potential. Schwab's ongoing commitment to innovation, customer-centric solutions, and strategic partnerships will be crucial as it navigates the evolving financial landscape and seeks to maintain its leadership position in the industry.

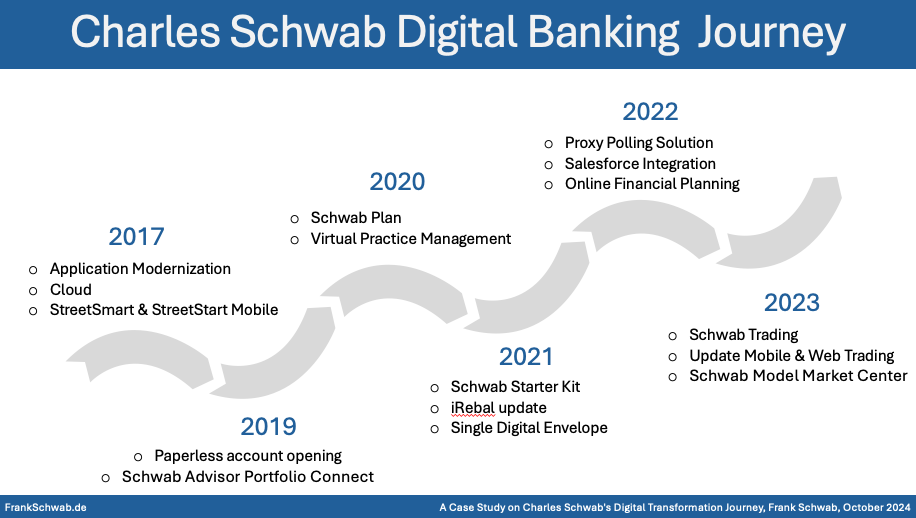

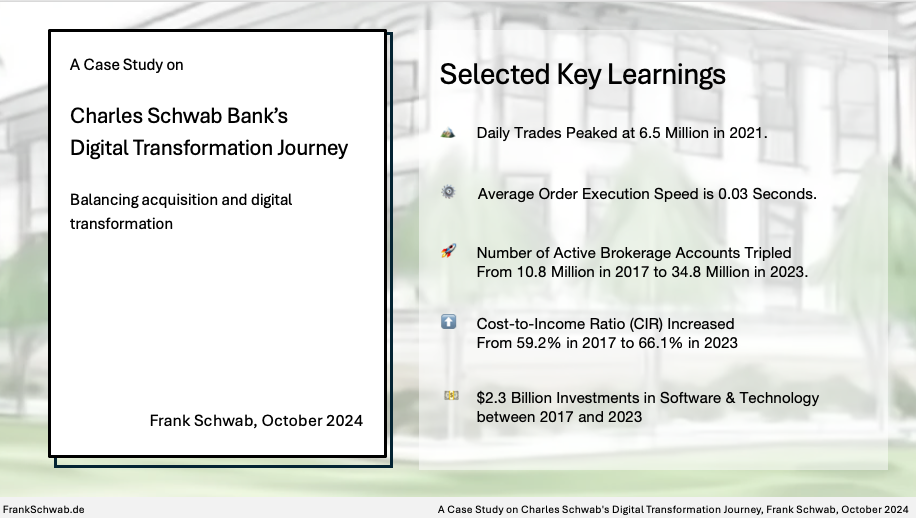

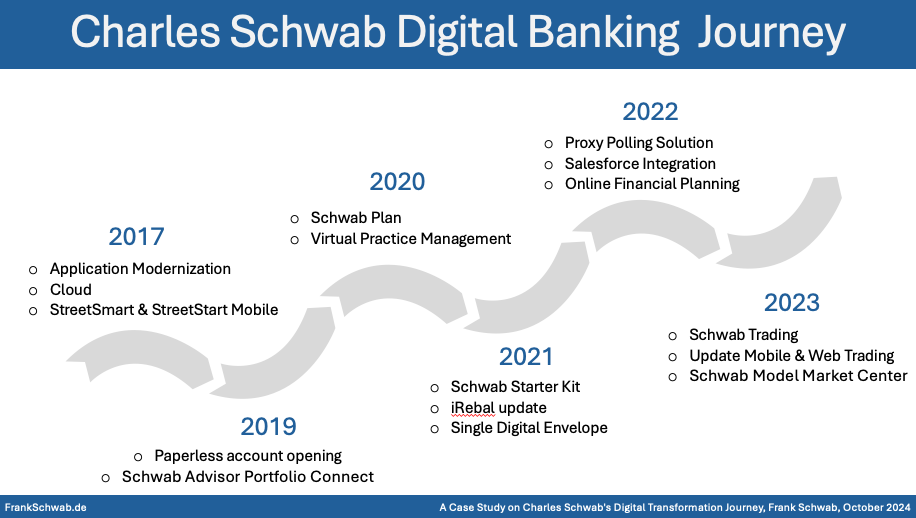

The Charles Schwab Corporation, established in 1971, has grown into a significant financial services provider with a market capitalization of USD 115 billion as of September 2024. Schwab's acquisition of TD Ameritrade in 2020 marked a pivotal moment, expanding its balance sheet from USD 243 billion in 2017 to USD 667 billion in 2021. Despite challenges from the Federal Reserve's interest rate hikes since 2022, which reduced net interest margins from 94% in 2020 and 2021 to 59% in 2023, Schwab maintained strong cost management, with operational expenses at 0.16% of average client assets. The company has also made significant strides in digital transformation, implementing innovations such as a fully digital lending solution and enhancements to Schwab Personalized Indexing and iRebal platforms. Integration with Salesforce Financial Services Cloud and the Financial Planning Action Center further highlights Schwab's focus on improving client-advisor collaboration.

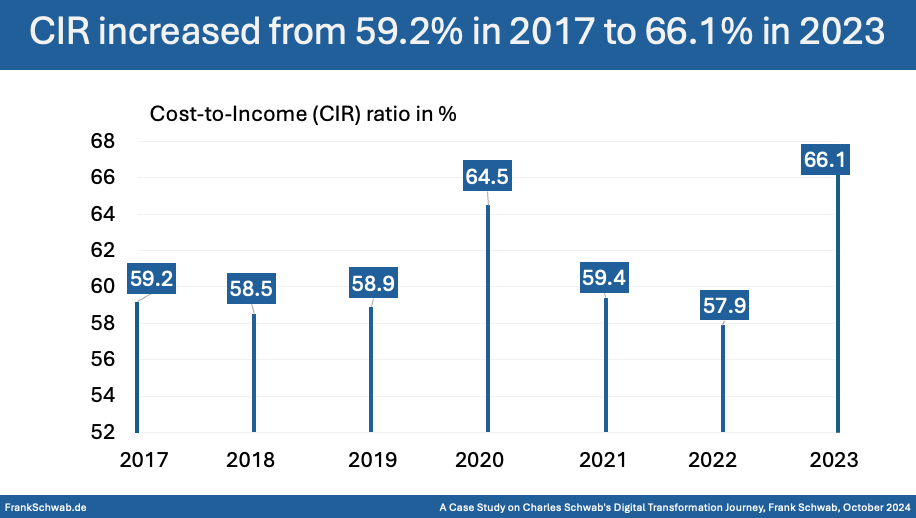

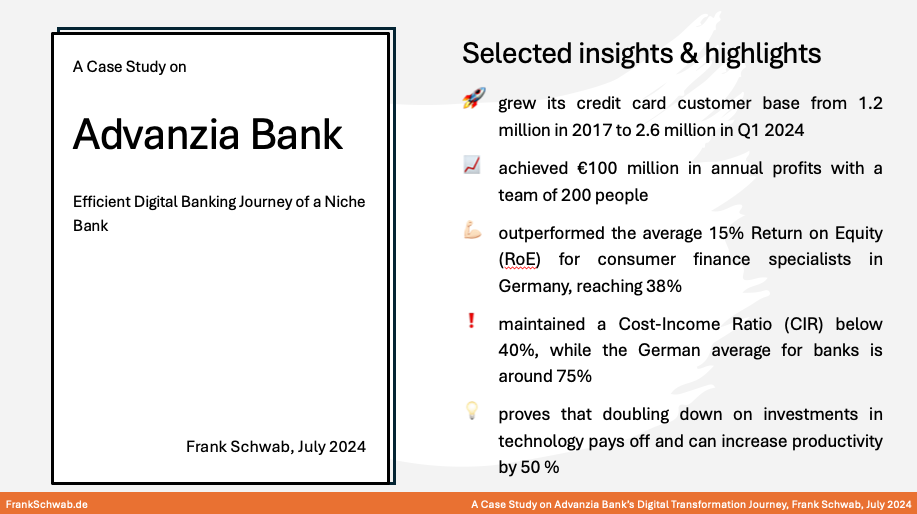

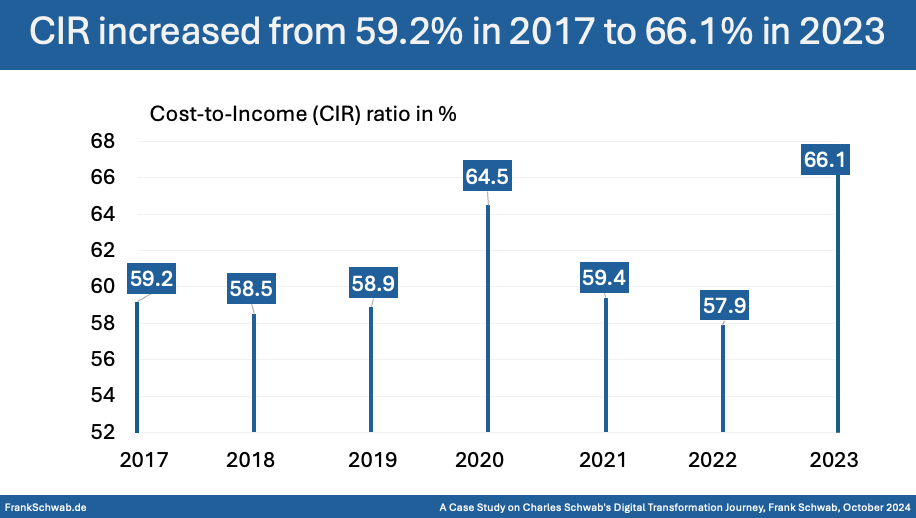

Schwab's operational efficiency, however, has faced challenges, as indicated by a rise in the Cost-to-Income ratio from 59.2% in 2017 to 66.1% in 2023. Despite growth in assets per employee from USD 13.82 million to USD 14.93 million and a modest increase in profit per employee from USD 0.13 million to USD 0.15 million, these metrics reveal limited progress. The acquisition of TD Ameritrade, while driving substantial growth, also introduced integration complexities, showcasing the delicate balance Schwab must maintain between growth, innovation, and operational efficiency.

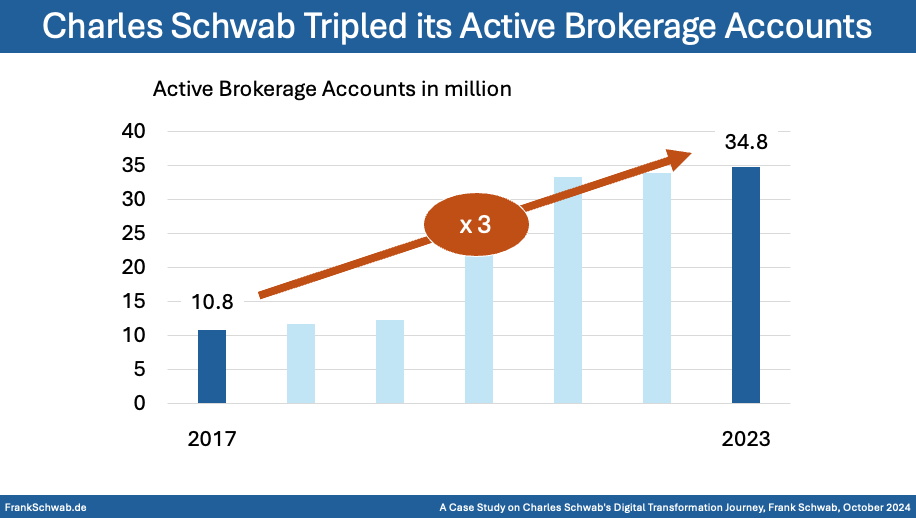

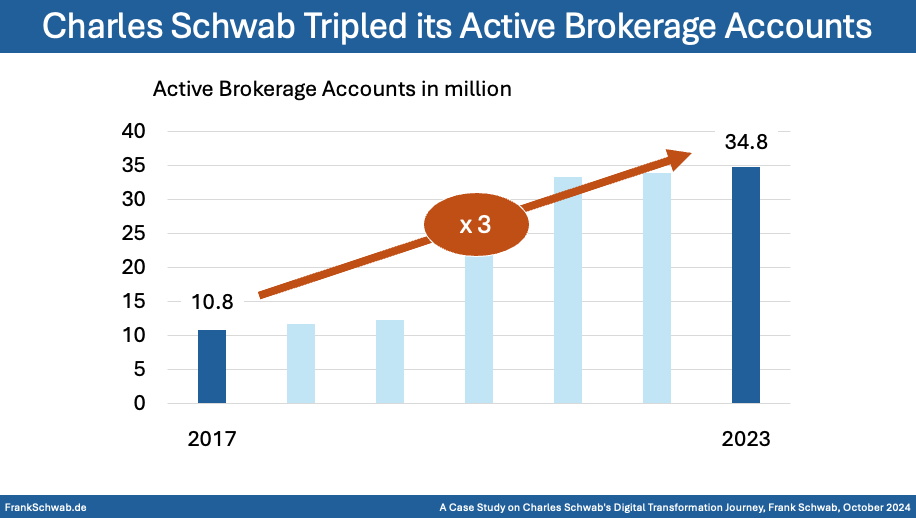

Charles Schwab's strategic focus on expanding its investment and advisory business is evident in the threefold increase in active brokerage accounts and growth in client assets per employee. As of December 31, 2023, the company managed USD 8.5 trillion in client assets across 34.8 million active brokerage accounts, 5.2 million corporate retirement plan participants, and 1.8 million banking accounts. Its diverse product offerings include brokerage, trading, retirement, and small business accounts, alongside an array of investment products like mutual funds, ETFs, stocks, bonds, and fixed income securities. Schwab’s banking and borrowing solutions are designed to complement its investment services, with features like no-fee checking accounts linked to brokerage accounts and competitive lending products such as home loans and margin loans against securities.

Financially, Schwab's performance from 2017 to 2023 reflects significant growth and adaptation to changing market conditions. From 2017 to 2021, Schwab's balance sheet grew at a compound annual growth rate (CAGR) of 29%, driven by strategic acquisitions and favorable market conditions. This expansion was mirrored in its market capitalization, which increased from USD 69 billion in 2017 to USD 159 billion in 2021. However, the aggressive interest rate hikes by the Federal Reserve in 2022-2023, raising the Fed Funds rate eleven times, significantly impacted Schwab's financials, leading to a decline in net revenue from USD 20.76 billion in 2022 to USD 18.84 billion in 2023, and a reduction in balance sheet size to USD 493 billion in 2023.

Despite these headwinds, Schwab has maintained strong risk management practices, reflected in a consistent Liquidity Coverage Ratio that reached 130% in 2023. The company's operational challenges are underscored by stagnant operational efficiency metrics, as assets per employee only slightly increased, and the profit per employee growth remained minimal. Nevertheless, Schwab's focus on digital transformation has positioned it well for future growth, with initiatives such as the launch of fully digital lending solutions and significant enhancements to platforms like iRebal and Schwab Personalized Indexing.

Schwab's revenue generation primarily stems from its Investor Services and Advisor Services segments. The Investor Services segment provides a broad range of financial products and services, including brokerage and advisory services, while the Advisor Services segment supports independent investment advisors. Both segments have faced revenue pressures due to market conditions, but Schwab's commitment to innovation and cost management has helped sustain its profitability. In 2023, the Investor Services segment generated USD 14.4 billion in net revenues, while the Advisor Services segment contributed USD 4.4 billion.

Schwab's revenue is derived from four primary sources: net interest revenue, asset management and administration fees, trading revenue, and company deposit account fees. Net interest revenue has consistently been a key component, accounting for approximately 50% of total revenue. However, rising interest expenses due to the Fed's rate hikes have compressed margins. Asset management fees have shown a gradual shift toward trading revenues, reflecting Schwab's adaptation to changing client needs and market dynamics.

To maintain healthy margins, Schwab has implemented several strategic measures, including a focus on effective cost management and digital transformation. Despite the challenges of declining net interest margins, Schwab has kept its operational expenses under control, consistently managing them at 0.16% of average client assets. This disciplined approach has been crucial in optimizing the company's Cost-to-Income Ratio, although recent pressures have led to a slight increase in this metric.

Charles Schwab's economic success is set against a backdrop of strong national economic growth, with U.S. GDP growing at an average rate of 2.25% from 2017 to 2023. Schwab's performance in this period has outpaced national trends, particularly in deposit growth and loan issuance, where it achieved higher growth rates than the national averages. Schwab's client assets also grew faster than the U.S. average, demonstrating its strong market positioning and ability to capitalize on economic opportunities.

While Schwab has demonstrated robust growth in deposits and loans, its operational effectiveness remains an area for improvement. Key operational metrics, such as assets per employee and profit per employee, have shown limited progress, highlighting the need for continued focus on enhancing efficiency. Despite these challenges, Schwab's strategic investments in digital transformation, such as the launch of a fully digital lending solution and ongoing enhancements to its platforms, underscore its commitment to long-term growth and operational excellence.

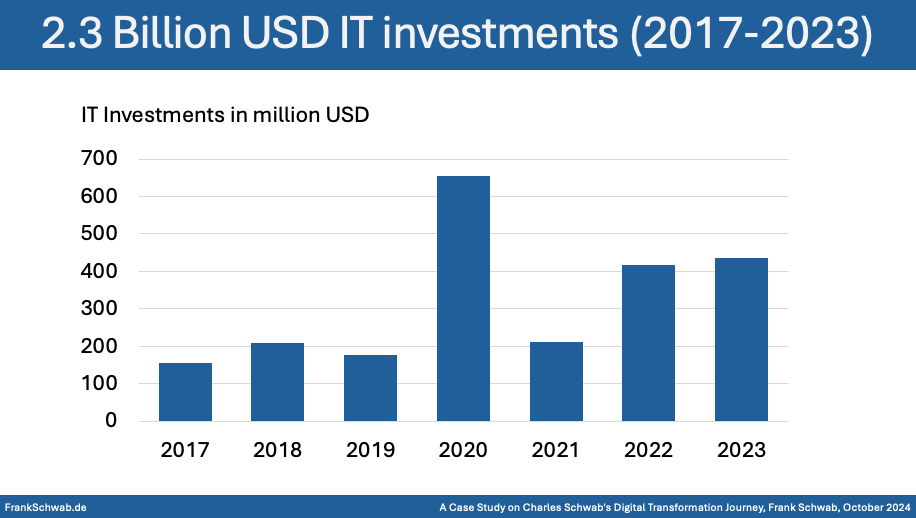

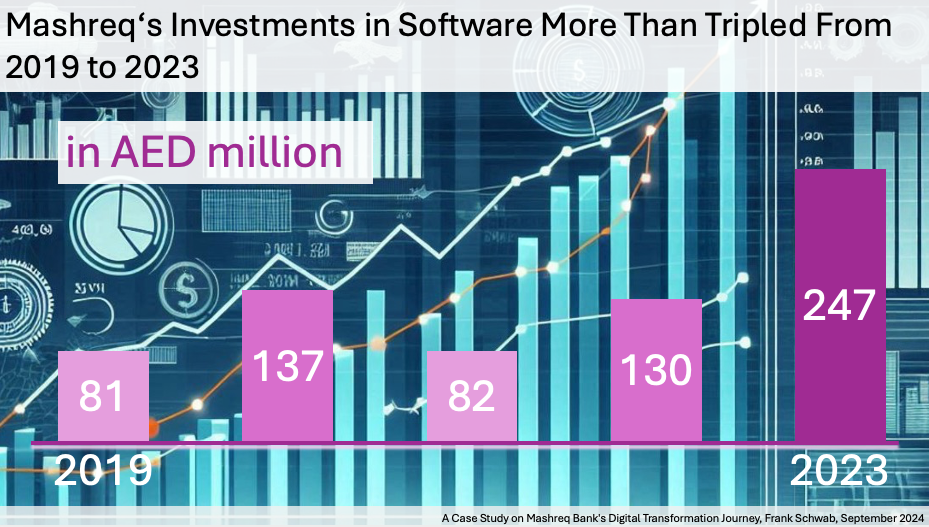

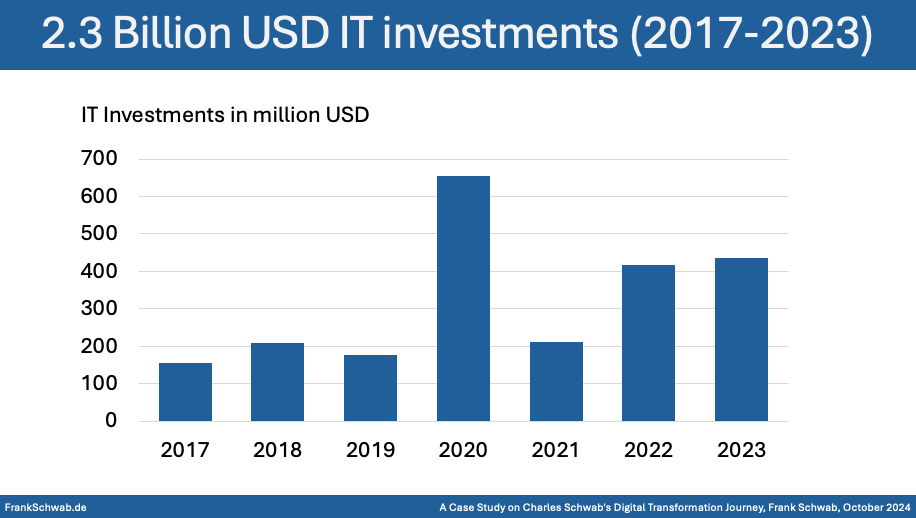

Schwab's digital transformation strategy has been pivotal in maintaining its competitive edge. The company has made substantial investments in technology, acquiring software and technology worth USD 2.25 billion from 2017 to 2023. Key digital initiatives include the launch of a fully digital lending solution, enhancements to Schwab Personalized Indexing, and the rollout of the Schwab Knowledge Assistant, which uses generative AI to streamline customer service. Schwab's focus on digital innovation has also been recognized through industry awards, such as the Most Trusted Bank Award from Investor’s Business Daily and the highest customer satisfaction score in the J.D. Power U.S. Satisfaction Study.

14 Pages Slideshare Presentation 🔗 https://bit.ly/3XQdy3U