Nedbank’s Digital Transformation Journey - digitizing for growth and customer satisfaction

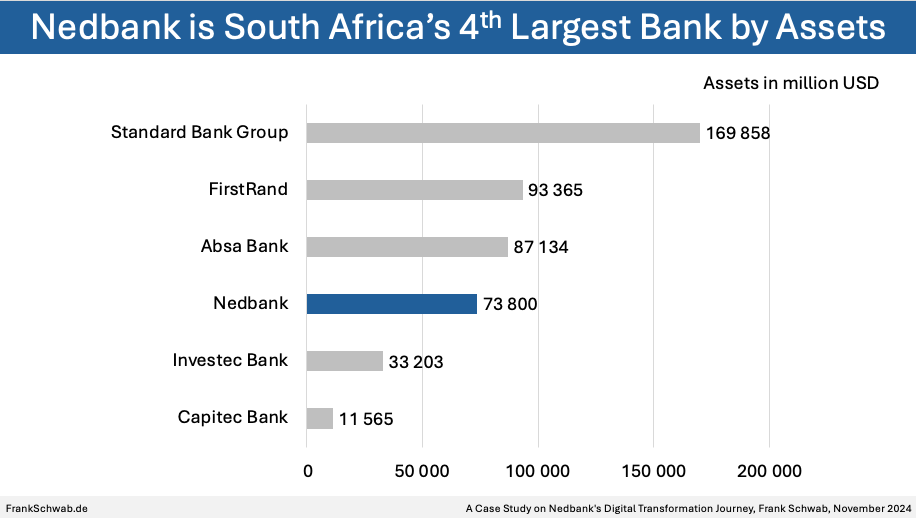

Nedbank has been a leader in the South African banking sector for over a century, and it has consistently adapted to the changing landscape of the industry. In 2023, Nedbank was the fourth largest bank in South Africa, with total assets of USD 73.5 billion, and it had 7.3 million clients. The bank has been on a digital transformation journey since 2010, and it has invested heavily in technology to improve its customer experience and operational efficiency.

Nedbank's digital strategy is based on the principle of "Digital when you want it; human when you need it." This approach allows customers to choose how they want to interact with the bank, whether it is through digital channels or in person. Nedbank has seen significant growth in its digital customer base and transaction volumes in recent years. In 2023, the bank had 2.9 million digitally active clients, and this number has been increasing by about 11% year over year. The bank's Money app has been particularly successful, with over 2.3 million active users in 2023, up 16% from 2022. In 2023, Money app transaction volumes increased by 18% year over year and by 315% since 2019.

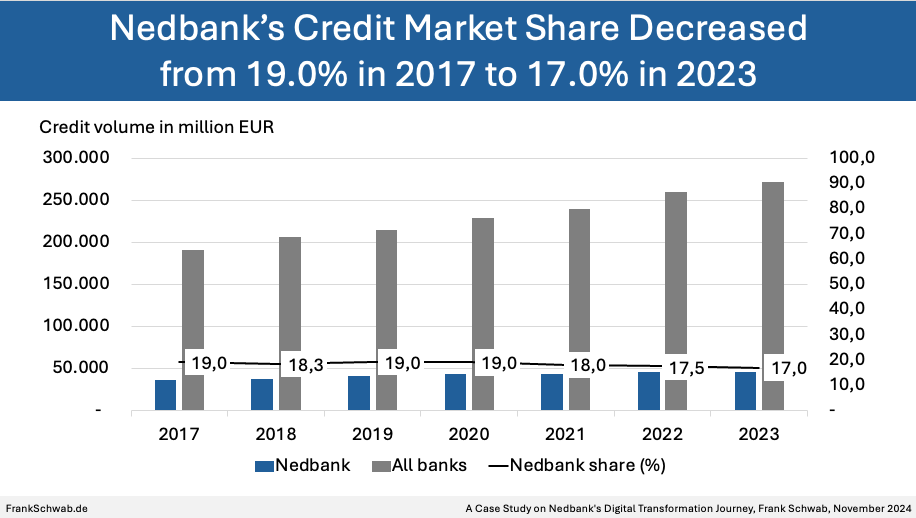

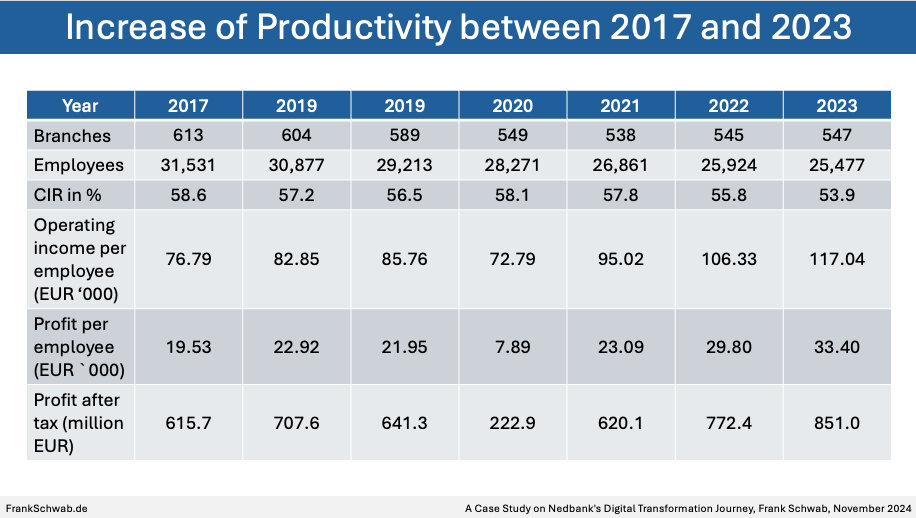

Overall, digital transactions across all channels were up 12% year over year and 98% since 2019. The increased use of digital channels has allowed Nedbank to reduce its reliance on traditional brick-and-mortar branches. The bank has reduced its branch network from 613 branches in 2017 to 547 branches in 2023. This has resulted in cost savings, which have been partially offset by investments in technology and skills development.

Nedbank is committed to using technology to improve its customer experience and operational efficiency. The bank is also exploring new ways to use technology to create new revenue streams and improve its risk management capabilities. Nedbank's digital transformation journey is ongoing, and the bank is well-positioned to continue to lead the way in the South African banking sector.

Nedbank has also achieved a number of other notable accomplishments in recent years. For example, in 2023, the bank was ranked #1 in customer satisfaction by Consulta, a leading South African research firm. The bank has also been recognized for its commitment to sustainability, and it was named the "Most Sustainable Bank in South Africa" by the World Finance Banking Awards in 2022.

Looking ahead, Nedbank is focused on continuing to grow its digital capabilities and expanding its reach into new markets. The bank is also committed to playing a leading role in the transition to a low-carbon economy. Nedbank is well-positioned for continued success in the years to come.

✍️ Contact me to learn more about the in-depth case study and receive the comprehensive 20+ page report, featuring detailed analysis and multiple informative graphs.

http://www.FrankSchwab.de

#banking #strategy #digital #digtialtransformation #digitaljourney

Published in CaseStudies, all on 05.11.2024 9:30 Uhr.

E-Mail address

Comment *