Frank Schwab

I bridge the gap between Visionary

Technology and Balance Sheet Profitability

Is Your Bank Running on Borrowed Time?

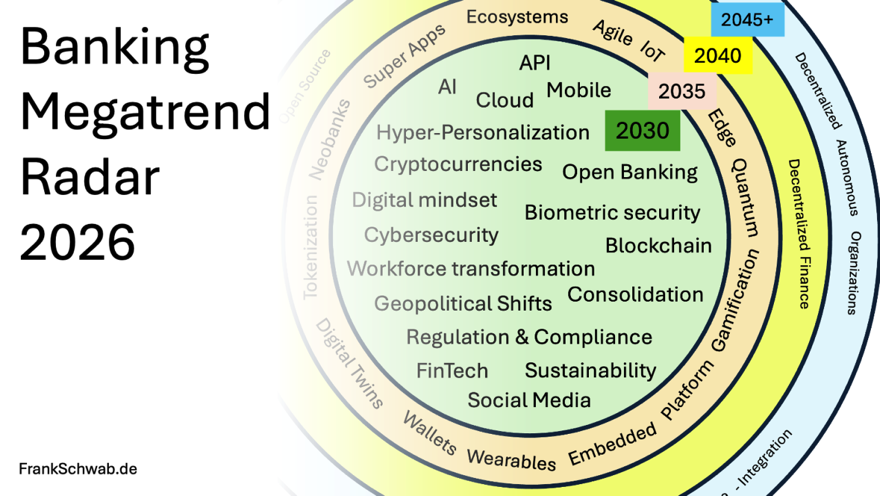

Banking is being reshaped by a powerful convergence of AI, cloud, APIs, blockchain, cybersecurity, and mobile-first technologies, forcing institutions to move from experimentation to full-scale industrial deployment. At the same time, fintech competition, crypto adoption, consolidation, and Open Banking are dismantling traditional business models and shifting banks from product providers to ecosystem orchestrators. Geopolitical fragmentation, regulatory complexity, and rising cyber risks mean banks must build resilient, automated, and globally adaptive operating frameworks to preserve trust and compliance. Ultimately, success will depend on a digital mindset that embraces hyper-personalization, workforce transformation, sustainability, and continuous upskilling as core strategic capabilities rather than optional initiatives.

1. The Rise of AI

Artificial Intelligence is no longer experimental; it is an economic engine projected to contribute an additional $13 trillion to global output by 2030. Banks must move beyond pilots to industrial-scale deployment, using AI to reduce fraud investigation times by up to 70% and power the real-time decision-making that modern customers demand.

2. APIs - Gateways to the Future

With 83% of IT leaders now considering APIs critical to business strategy, these digital bridges have become the central nervous system of the connected economy. They are the foundation of Open Banking, enabling banks to monetize data and services in a market where API management is projected to reach $13.7 billion by 2027.

3. Biometric Security

Over 50% of users now authenticate with biometrics daily, making passwords a relic of the past. Banks must implement multi-modal biometrics not just for convenience, but to secure a landscape where global biometric hardware revenue is set to exceed $50 billion by 2027.

4. Blockchain - Redefining Trust

Beyond the hype, blockchain is a serious efficiency driver capable of reducing trade finance operational costs by up to 80%. With predictions that 10% of global GDP will be stored on blockchain technology by 2027, banks must move from experimentation to integration to handle distributed ledgers and smart contracts.

5. Cloud's Strategic Imperative

The cloud is the only infrastructure capable of supporting modern agility, with migrations shown to cut IT costs by up to 50% and energy consumption by 65%. Banks must accelerate the migration of core systems to the cloud to access the scalability required for real-time processing and massive dataset analysis.

6. Consolidation Wave

The number of US banking institutions has plummeted from over 14,000 in 1984 to fewer than 4,500 in 2023, a clear signal that scale is now a survival metric. Banks must proactively assess their position to either acquire niche fintech capabilities or seek strategic mergers to avoid being marginalized by "super banks".

7. Cryptocurrencies - Money Evolved

With adoption growing by 880% in a single year in some regions , cryptocurrencies have transformed from a niche interest into a trillion-dollar asset class. Banks must stop viewing this as a passing fad and offer regulated crypto-custody and trading services to prevent liquidity from bleeding into the decentralized economy.

8. Cybersecurity Race

In an environment where cybercrime costs the global economy $600 billion annually, trust is a bank’s most fragile asset. With 43% of organizations reporting significant security breaches in recent years, banks must adopt "Zero Trust" architectures and AI-driven defense systems as a baseline for doing business.

9. Embracing the Digital Mindset

The World Economic Forum predicts 85 million jobs will be displaced by automation by 2025, while 97 million new tech-centric roles will emerge. This shift demands that banks radically upskill their workforce and flatten hierarchies to foster a culture of adaptability that can survive in a digital-first economy.

10. The Fintech Era

Fintechs are no longer just nibbling at the edges; they are devouring market share with global funding hitting $23.2 billion in just the first quarter of 2024. Banks must pivot from ignoring these agile competitors to partnering with or acquiring them to capture the efficiency and user-centricity that is eroding traditional margins.

11. Geopolitical Shifts

The era of a stable, unipolar world is over, evidenced by China’s share of global GDP rising from 3.2% to 18.5% in just three decades. Banks are now the frontline enforcers of sanctions and must build resilient, diversified frameworks to navigate a fragmented global financial system defined by volatility and de-globalization.

12. Hyper-personalizationEverywhere

80% of consumers are now more likely to purchase from brands that offer tailored experiences, making generic banking products obsolete. Banks must leverage data analytics to offer "Segment of One" experiences, predicting customer needs before they are articulated, just as 75% of banks are already investing in AI to do.

13. The Mobile Future is Here

With global smartphone penetration at 76% and mobile data traffic growing 52-fold in a decade, the smartphone is the primary bank branch. Banks must design for a "mobile-first" reality where poor app experience is the leading cause of churn and where digital wallets are becoming the primary interface for financial life.

14. Open Banking

The Open Banking market is projected to reach $43.15 billion by 2026, fundamentally breaking the bank's monopoly on customer data. Banks must transition from being compliant data holders to active ecosystem orchestrators, aggregating third-party services to remain the central financial hub for the customer.

15. Complexities of Regulation & Compliance

With the RegTech market set to reach $128.2 billion by 2027, manual compliance is no longer a viable option. As 66% of organizations increase their compliance budgets, banks must automate these processes to avoid crushing penalties and navigate an increasingly granular regulatory landscape.

16. A Social Media-Driven World

In a world where 70% of consumers rely on social media for financial decisions, a bank's reputation is managed in real-time public forums. Banks need robust social listening strategies and must integrate banking services directly into social platforms to capture the "social commerce" market.

17. Sustainability - The Future is Green

With global ESG assets exceeding $35 trillion , sustainability has moved from a PR exercise to a core investment criteria for 83% of investors. Banks must embed ESG metrics into their lending criteria and measure the carbon footprint of their portfolios to align with the demands of regulators and modern consumers.

18. Workforce Transformation

The gig economy now engages 20-30% of the working-age population, radically changing income patterns and credit risk profiles. Banks must modernize their HR policies to attract digital talent and develop products tailored to a workforce defined by flexibility, remote work, and non-traditional income streams.

📖 🔗 🇬🇧 https://a.co/d/dE5WMJt

📖 🔗 🇩🇪 https://amzn.eu/d/g0esVsr

#Banking #FutureOfFinance #DigitalTransformation #Fintech #42Megatrends #BankingInnovation #AI #Cybersecurity #Leadership

© Frank Schwab 2026