Discover how board members wield 25 Key Performance Indicators (KPIs) as their compass, guiding the institution towards digital excellence. Dive deep into the themes of Customer Experience & Adoption, Innovation, Financial Performance, Operational Efficiency, Cybersecurity, and Regulatory Compliance, unlocking insights crucial for navigating the complexities of modern banking. As the landscape evolves, so too must the metrics; witness the evolution from adoption to revenue generation, ensuring adaptive oversight at every turn.

When it comes to overseeing a bank's digital transformation, board members play a critical role in setting strategic direction and ensuring that the organization achieves its objectives effectively. Key Performance Indicators (KPIs) are essential tools for board members to monitor progress, assess the impact of digital initiatives, and make informed decisions.

Beyond mere tracking, KPIs serve as litmus tests for evaluating the success or need for course correction in transformation efforts. They provide evidence of ROI for significant digital investments, aligning with boards' fiduciary duty to shareholders. Moreover, KPIs aid in risk management by tracking potential threats like cybersecurity, enabling proactive measures to address vulnerabilities. By benchmarking against industry standards, boards gain insight into the competitive landscape, shaping strategies for maintaining competitiveness.

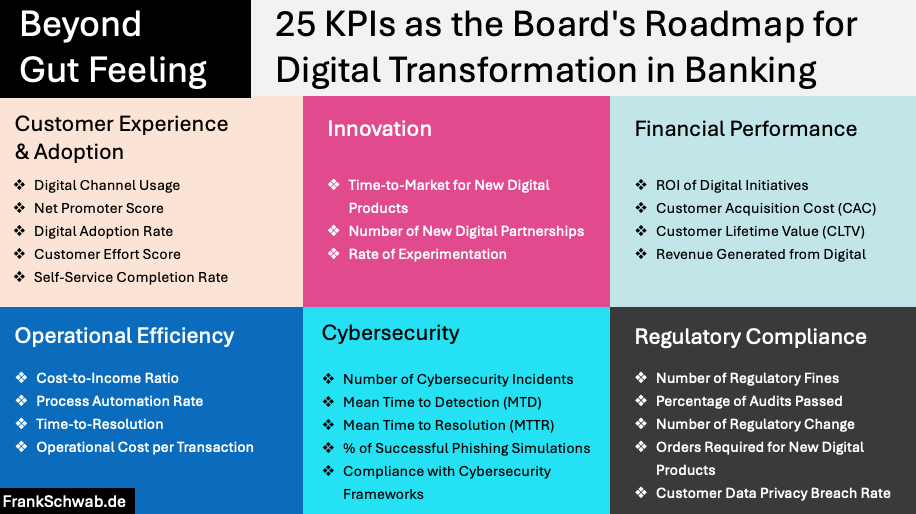

Enclosed 25 KPIs are indispensable for board members during a bank's digital transformation:

I) Customer Experience & Adoption KPIs provide insights into how well the bank is meeting customer expectations and adapting to changing preferences. Board members need to understand the level of digital channel usage, Net Promoter Score (NPS) for digital channels, Digital Adoption Rate, Customer Effort Score (CES), and Self-Service Completion Rate to gauge the success of digital initiatives in enhancing customer experience and driving adoption. By tracking these metrics, board members can ensure that the bank remains customer-centric and competitive in the digital age.

II) Innovation KPIs help board members evaluate the bank's ability to innovate and adapt to a rapidly changing digital landscape. Metrics such as Time-to-Market for New Digital Products, Number of New Digital Partnerships, and Rate of Experimentation reflect the bank's agility, creativity, and willingness to embrace innovation. By tracking these KPIs, board members can assess the bank's competitive positioning, identify emerging opportunities, and ensure that the organization remains at the forefront of industry innovation.

III) Financial Performance KPIs offer board members valuable insights into the financial implications of digital transformation. Metrics such as Return on Investment (ROI) of Digital Initiatives, Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), and Revenue Generated from Digital Channels enable board members to assess the profitability and sustainability of digital initiatives. Understanding these KPIs allows board members to make informed decisions regarding resource allocation, investment prioritization, and revenue generation strategies.

IV) Operational Efficiency KPIs are vital for board members to assess the operational impact of digital transformation. Metrics such as Cost-to-Income Ratio, Process Automation Rate, Time-to-Resolution for support tickets, and Operational Cost per Transaction help board members evaluate the efficiency gains achieved through digitalization efforts. By monitoring these KPIs, board members can identify areas for optimization, cost reduction, and process improvement, ultimately driving operational excellence across the organization.

V) Cybersecurity KPIs offer critical insights into the bank's resilience against digital threats and its ability to protect sensitive data and systems from malicious actors. Metrics such as Number of Cybersecurity Incidents, Mean Time to Detection (MTD), Mean Time to Resolution (MTTR), Percentage of Successful Phishing Simulations, and Compliance with Cybersecurity Frameworks provide board members with a comprehensive view of the bank's cybersecurity posture. It's important to balance security with customer experience. Overly stringent security measures might frustrate users. By monitoring these KPIs, board members can assess the effectiveness of the bank's security measures, identify potential vulnerabilities, and prioritize investments in cybersecurity infrastructure and employee training.

VI) Finally, regulatory compliance is another area of paramount importance for board members during a bank's digital transformation. Regulatory KPIs help board members assess the bank's adherence to legal and regulatory requirements, mitigate compliance-related risks, and maintain the organization's reputation and trustworthiness. Metrics such as Number of Regulatory Fines, Percentage of Audits Passed, Number of Regulatory Change Orders Required for New Digital Products, and Customer Data Privacy Breach Rate offer valuable insights into the bank's compliance efforts.

⚡️Important to note: the best KPIs evolve with the transformation's phases. Early on, focus may be on adoption, and later, the emphasis could shift to revenue generation. Boards need adaptable oversight.

In summary, these 25 KPIs are essential for board members during a bank's digital transformation because they provide valuable insights into customer experience, innovation, financial performance, operational efficiency, cybersecurity, and regulatory compliance. By monitoring these KPIs closely, board members can effectively oversee the digital transformation process, drive strategic decision-making, and ensure the long-term success of the organization in an increasingly digital-centric world.

Download the slides on SlideShare 🔗 https://bit.ly/4d3pJ37

E-Mail address

Comment *