Unravel the Mystery of Crypto Investing - 8 Essential Themes

1️⃣ Check the Backgrounds of the Leadership & Team Members

One of the fundamental aspects of investing in cryptocurrencies is to thoroughly investigate the individuals behind the project. Examining their LinkedIn profiles, CVs, and assessing whether they are part-time or full-time contributors can provide valuable insights into their commitment and expertise. Additionally, evaluating their track record in previous projects can be instrumental in gauging their capability and reliability.

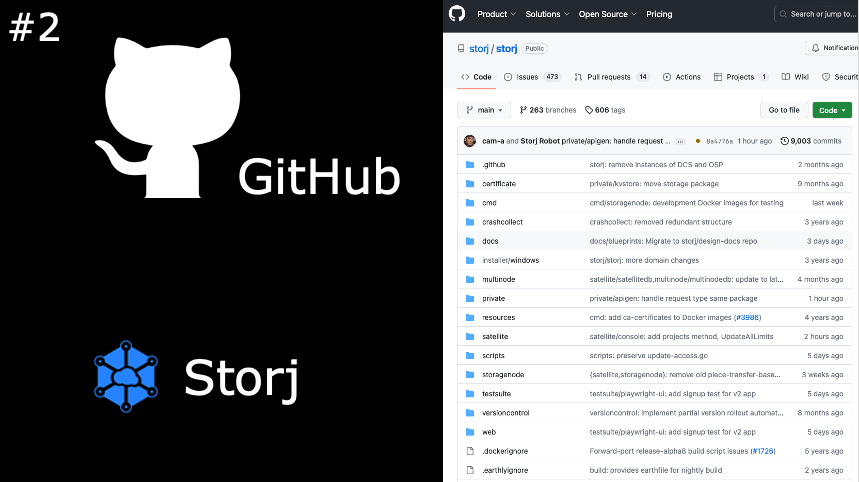

2️⃣ Code Activity Speaks For Itself

Most crypto projects are open source. Platforms like GitHub, serving as the repository for open-source code, are a treasure trove of information for cryptocurrency investors. Analyzing the project's coding activities can provide insight into the development team's breadth, dedication, and competence. Consistently active and transparent activities from numerous developers, along with progress updates, indicate a healthy and vibrant development community.

3️⃣ Test the Available Tools

The usability and functionality of the tools provided by a cryptocurrency project are crucial. Testing the website, apps, wallets, and other market-related tools can reveal the functionality, the convenience and user experience offered. A broad and deep ecosystem provides good indications of the seriousness and success prospects of a crypto project.

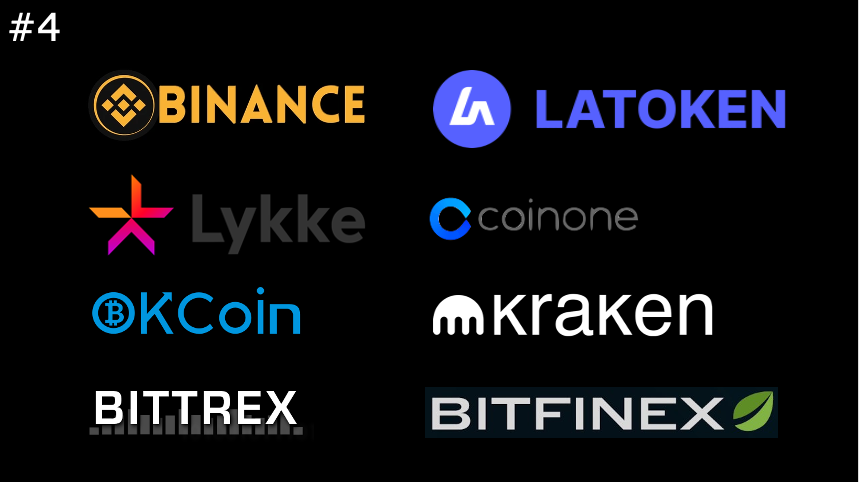

4️⃣ Assessing Exchange Support

To make informed investment decisions, it is crucial to assess the exchanges that support a specific cryptocurrency. Liquidity and market accessibility are directly influenced by the platforms on which a cryptocurrency is listed. Investigating the legal standing of these exchanges in relevant countries, their market approach, and any noteworthy stories associated with them offers valuable context for shaping a well-rounded investment strategy.

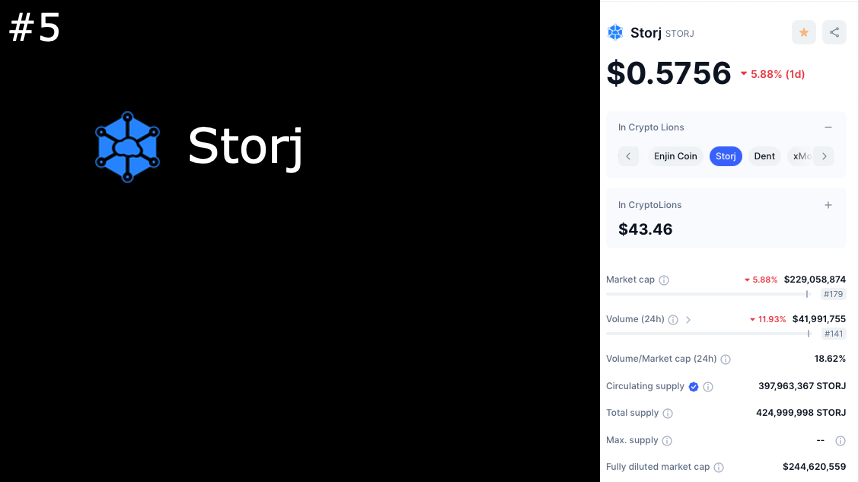

5️⃣ Understanding Tokenomics

In grasping the intricacies of tokenomics, one must delve into the fundamental principles governing a cryptocurrency's economic framework. This involves examining factors such as token supply, utility, governance mechanisms, and incentive structures. A comprehensive understanding of tokenomics is essential for navigating the dynamic landscape of decentralized economies and making informed investment decisions.

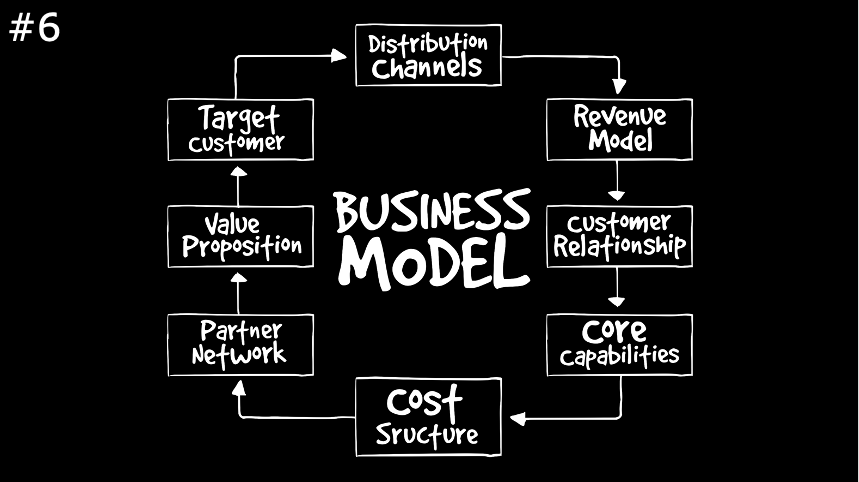

6️⃣ Understanding the Underlying Business Model

Investors should delve into the underlying business model of a cryptocurrency. How does the project generate value for its users and stakeholders? Understanding the utility and purpose of the coin can help assess its potential for long-term success.

7️⃣ Evaluating the Potential of the Coin

Assessing the potential of a cryptocurrency involves considering factors such as its use case, technology, and market demand. Investors should look beyond short-term fluctuations and focus on the project's long-term viability, scalability, and relevance in the ever-evolving crypto landscape.

8️⃣ Analyzing Sales and Social Media Strategy

The success of a cryptocurrency often relies on effective sales and social media strategies. From expert forums like Reddit and Bitcointalk to mainstream platforms like Facebook and Twitter, understanding how the project is perceived across different channels is crucial. Additionally, evaluating its international reach, including strategies in key regions like Asia, China, and India, can provide insights into its global potential.

💡 In conclusion, navigating the complex world of cryptocurrency investments requires a diligent and multi-faceted approach. By following these eight themes, investors can make more informed decisions in the dynamic and rapidly evolving crypto market.

Published in crypto, bitcoin, cryptocurrency, all on 18.01.2024 17:19 Uhr.

E-Mail address

Comment *