Frank Schwab

I bridge the gap between Visionary Technology

and Balance Sheet Profitability

Sohar International Bank's Digital Transformation Journey

Building an Ecosystem, Delivering Excellence.

Executive Summary

Sohar International Bank executed a comprehensive digital transformation starting in 2018, responding to shifting customer expectations toward integrated, digital, and self-service banking models. The bank’s five-year strategy focused on customer-centricity, operational efficiency, and building a strong digital core rather than isolated digital solutions. This approach delivered measurable results, including strong growth in deposits, credit, assets, and profitability, alongside improved cost efficiency over the medium term. Digitalization also strengthened operational resilience, enabling Sohar International to outperform the Omani banking sector during periods of economic stress. The successful transformation positioned the bank to complete the strategic acquisition of HSBC Oman in 2023, materially increasing scale, liquidity, and market share. While the acquisition created short-term efficiency and integration challenges, it significantly improved the bank’s credit-to-deposit ratio and lending capacity. Sohar International’s strategy aligns closely with Oman Vision 2040 and reinforces its role as a key enabler of digitalization and financial inclusion. The board’s priority now is to execute a disciplined post-acquisition efficiency and integration program to translate strategic scale into sustainable long-term shareholder value.

Customer expectations in banking are undergoing a fundamental shift toward integrated, digital, and self-service models. This shift has accelerated the emergence of digital ecosystem banking, in which banks collaborate with partners to deliver financial and non-financial services through unified platforms. Sohar International Bank provides a compelling case study of how such a transformation can be executed at scale, creating both strategic optionality and measurable financial outcomes.

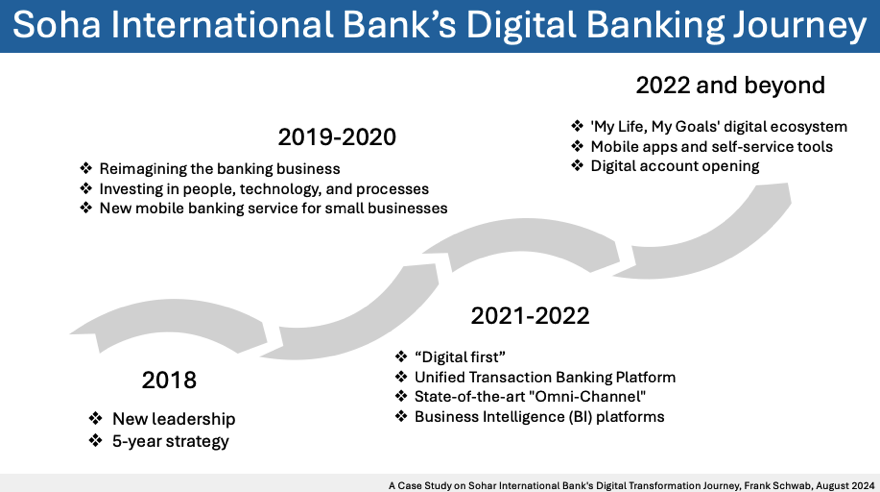

Sohar International initiated its digital transformation in 2018 following a change in ownership and the appointment of a new management team under CEO Ahmed Al Musalmi. A five-year strategy was defined with a clear focus on customer experience, operational efficiency, and digital enablement. Significant investments were made in people, technology, and processes, with the explicit objective of building a strong digital core rather than isolated digital front ends. This strategic clarity proved critical for execution discipline and long-term value creation.

Sohar International’s transformation aligns closely with Oman Vision 2040, particularly its emphasis on digitalization, financial inclusion, and sustainable economic growth. Retail transaction volumes in Oman increased by more than 260% between 2018 and 2022, reflecting the broader impact of digital payments and ecosystem models. Sohar International has been recognized as a key enabler of this national agenda, reinforcing its strategic relevance beyond purely financial performance.

In conclusion, Sohar International’s experience demonstrates that digital transformation, when executed as a core strategic program rather than a series of tactical initiatives, can materially improve competitiveness, resilience, and profitability. The bank enters its next phase from a position of strength, with scale, liquidity, and a proven digital foundation. The board’s focus should now be on disciplined post-merger integration and operational efficiency, ensuring that the strategic gains achieved over the past five years translate into sustainable long-term value for shareholders and stakeholders alike.

Case Study (21 pages) 📧 Frank@FrankSchwab.de

#banking #strategy #digital #digitaljourney

#casestudy

At the center of the transformation was a deliberate shift toward customer-centricity. Sohar International reimagined its retail and corporate offerings through digital channels, resulting in a comprehensive ecosystem that enables customers to transact, manage accounts, access support, and consume additional services through a single digital interface. For corporate clients, a unified transaction banking platform streamlined onboarding, payments, liquidity management, and trade finance. For retail customers, mobile banking evolved into a one-stop digital hub extending beyond traditional banking services. This focus on usability and self-service materially improved customer engagement and operational efficiency.

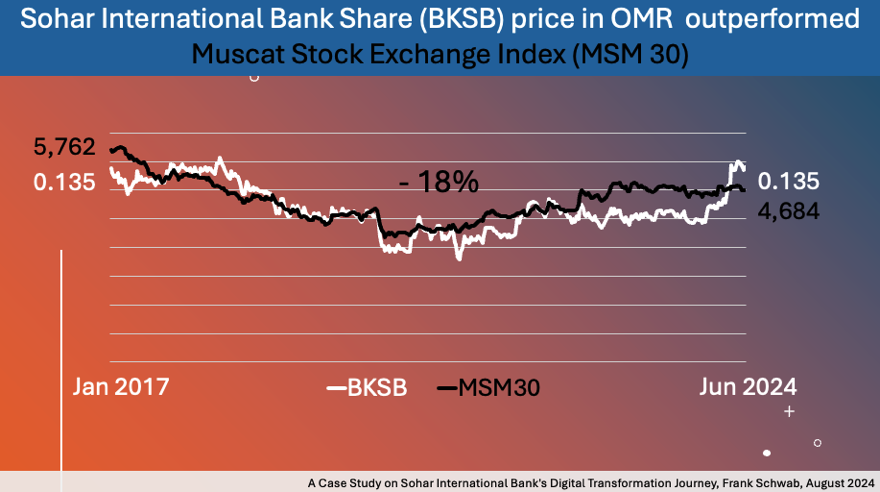

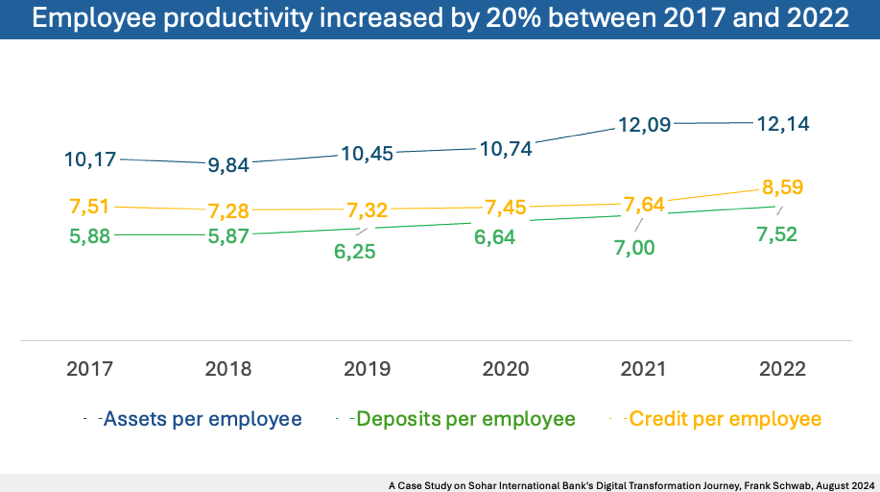

The transformation delivered measurable financial and strategic results. Between 2017 and 2022, Sohar International increased its market share of deposits from 8% to 10%. Deposits grew by 56%, credit volumes by 39%, and total assets by 45%. Operating income increased by 74% and net income by 38% over the same period. While investment in technology and talent increased the cost base in the short term, disciplined execution led to an improvement in the cost-to-income ratio over the medium term. Digitalization thus acted as a structural profitability lever rather than a permanent cost burden.

Operational resilience emerged as a further outcome of the digital strategy. Automation, data analytics, and AI-enabled services strengthened risk management, fraud detection, and customer support. During the COVID-19 pandemic, Sohar International demonstrated a high degree of adaptability by scaling digital channels, enhancing cybersecurity, and maintaining uninterrupted service delivery. These capabilities supported organic growth and enabled expansion into new markets, including Saudi Arabia, prior to the HSBC Oman acquisition.

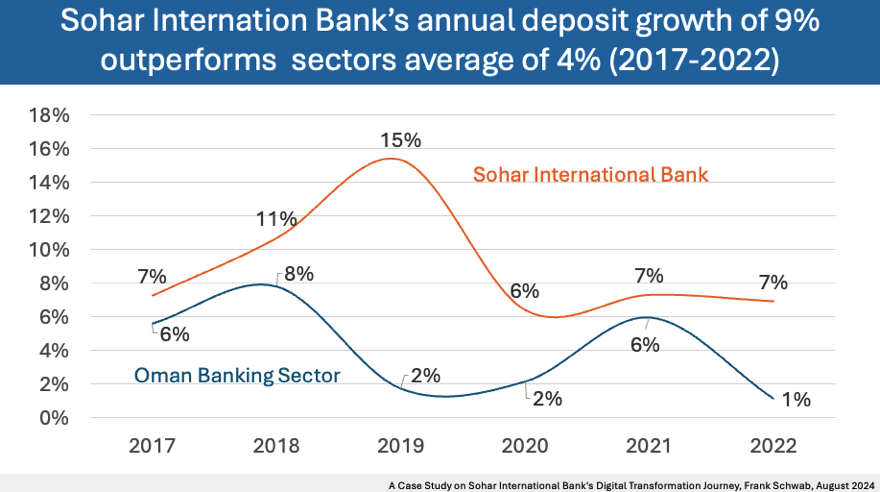

Against a backdrop of economic headwinds in Oman, including GDP contraction and sector consolidation, Sohar International consistently outperformed the domestic banking sector. Average annual deposit growth reached 9%, compared with a sector average of 4%, while credit growth averaged 7% versus 5% for peers. Capital adequacy strengthened to over 20%, and return on equity remained in line with industry averages, reflecting a balanced approach to growth, risk, and capital management. The bank’s digital leadership was further reinforced through multiple national and regional awards between 2018 and 2023.

The acquisition of HSBC Oman in August 2023 marked a strategic inflection point. The transaction doubled deposits to over USD 13 billion and increased market share from 10% to 18%. The credit-to-deposit ratio improved significantly, strengthening liquidity and lending capacity. However, the acquisition also introduced short-term efficiency challenges, including a temporary increase in the cost-to-income ratio and dilution in selected productivity metrics due to workforce and systems integration. These effects are typical for transactions of this scale and underscore the importance of post-merger execution.

Looking ahead, the strategic priority is clear. Sohar International must now shift focus from expansion to optimization. A structured post-acquisition re-engineering and efficiency program is essential to capture the full value of the HSBC Oman transaction. This should include system and process consolidation, elimination of redundancies, and targeted upskilling of employees to operate effectively in a digital-first environment. Leveraging the bank’s existing automation and digital infrastructure will be critical to restoring and improving productivity metrics.

© Frank Schwab 2026