Frank Schwab

I bridge the gap between Visionary Technology

and Balance Sheet Profitability

NatWest Group’s Digital Transformation Journey

From Bailout to Benchmark

Executive Summary

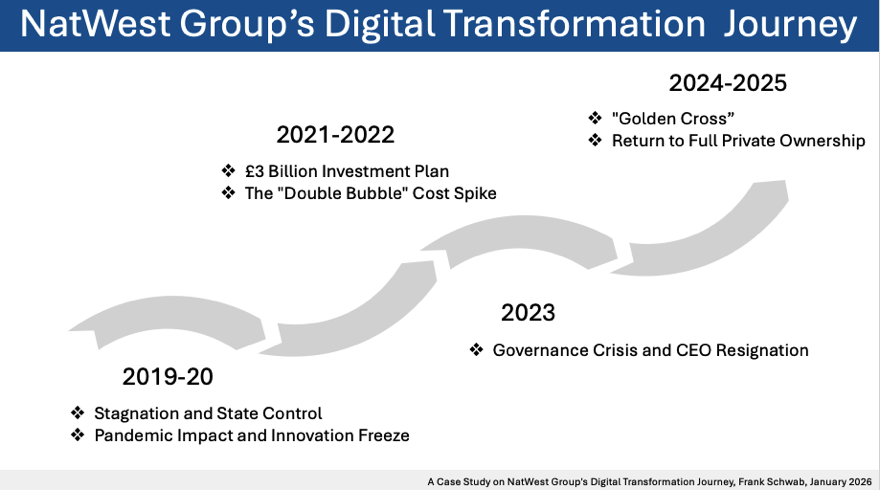

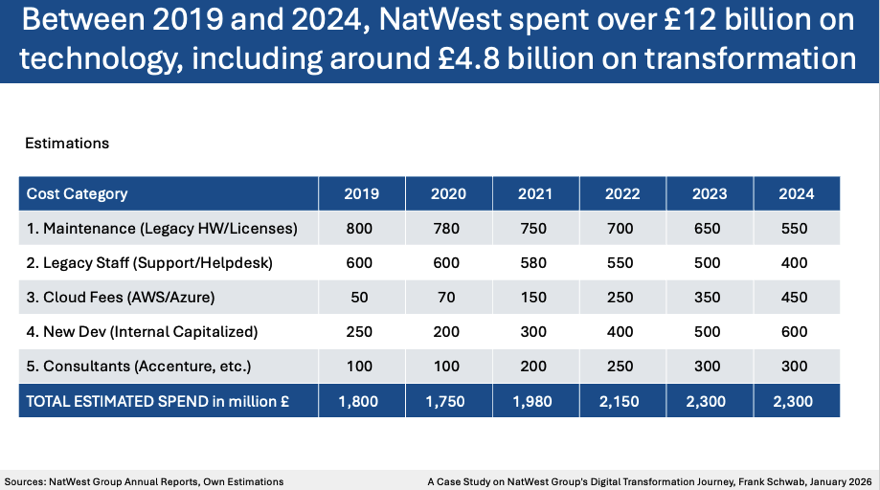

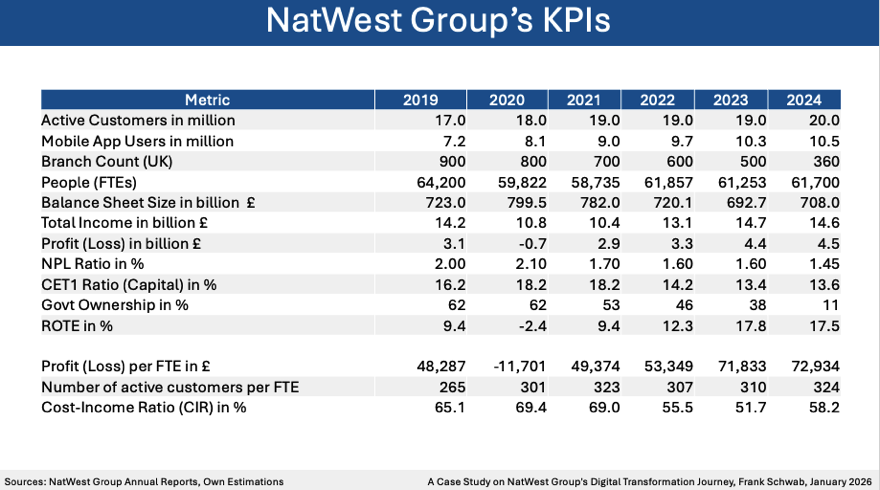

NatWest Group’s transformation between 2019 and 2025 illustrates how a legacy bank can move from state dependency to digital leadership. In 2019, the bank was still majority-owned by the UK government and constrained by high technical debt. Most technology spending was absorbed by legacy maintenance rather than innovation. The COVID-19 crisis in 2020 further delayed modernization and resulted in a significant financial loss. A strategic inflection point emerged in 2021 with the launch of a multi-year investment program aimed at rebuilding the core technology stack. This transition required enduring a costly interim phase in which old and new systems ran in parallel. Despite governance challenges and public scrutiny, the bank maintained operational stability. By 2024, digital investment overtook legacy spend, signaling a structural shift. Full privatization in 2025 marked the completion of both financial and technological recovery.

NatWest Group’s Company Profile

NatWest Group is a UK-focused banking institution shaped by centuries of history and a turbulent modern past. The group emerged from the 2000 acquisition of NatWest by RBS and the subsequent 2008 financial crisis. Government ownership defined its strategy for more than a decade. Over time, the bank deliberately exited global investment banking to reduce volatility. Today, NatWest operates a multi-brand domestic model serving retail, commercial, and wealth customers. Its brands reflect regional identities while sharing a common digital backbone. The bank serves around 20 million customers primarily in the UK and Ireland. This geographic focus supports capital efficiency and regulatory clarity. NatWest’s modern positioning emphasizes relationship banking supported by scalable digital infrastructure.

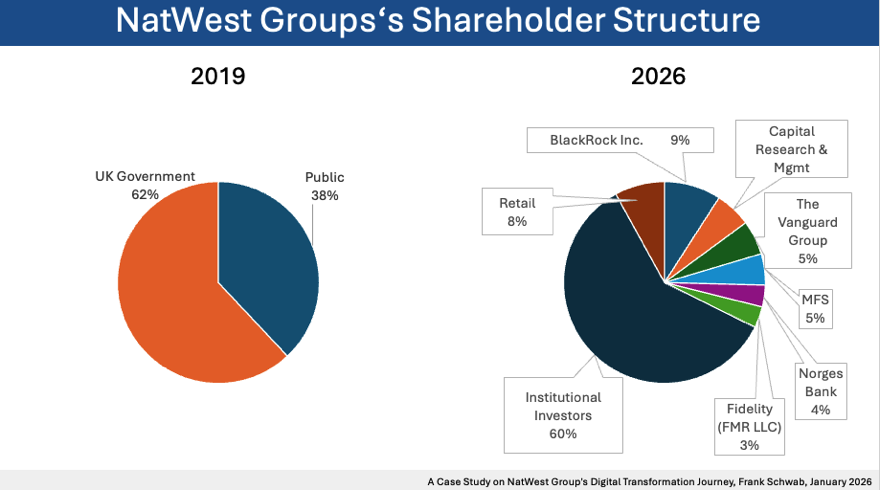

NatWest Group’s Shareholder: The Long Road to Normalcy

Government ownership had shaped NatWest’s strategic constraints for years. Large state holdings created persistent uncertainty for investors. The bank gradually reduced this stake through buybacks and market sales. Capital strength enabled self-funded privatization. A planned retail sale was ultimately abandoned to maximize value. Institutional investors replaced the state as core shareholders. By May 2025, the government had fully exited. The shareholder base became globally diversified. Privatization restored full commercial discipline. Ownership normalization reinforced strategic independence.

Conclusions

NatWest’s journey demonstrates that digital transformation is fundamentally an economic restructuring. Technology investment must be sustained through periods of rising costs. Shifting spend from maintenance to development is the critical turning point. Governance and capital allocation are as important as architecture. Digital-first models can materially improve efficiency and returns. Legacy banks can modernize without sacrificing stability. Resilience during crises validates transformation depth. Full privatization crowned the recovery process. NatWest emerged as a benchmark rather than an exception.

Case Study (11 pages) 📧 Frank@FrankSchwab.de

#banking #strategy #digital #digitaljourney

#casestudy

Driving Growth in Solopreneur, Merchant, and Youth Segments

NatWest complemented its core banking business with targeted digital ventures. The strategy focused on embedding financial services into customers’ daily workflows. Mettle was designed to serve solopreneurs with integrated accounting capabilities. This reduced churn by locking banking into business operations. Tyl expanded the bank’s presence in merchant acquiring and payments. The youth segment was addressed through Rooster Money, capturing customers early in their financial lifecycle. These platforms extended the bank beyond traditional products. Each venture was built to scale digitally with low marginal cost. Together, they diversified revenue and strengthened customer engagement.

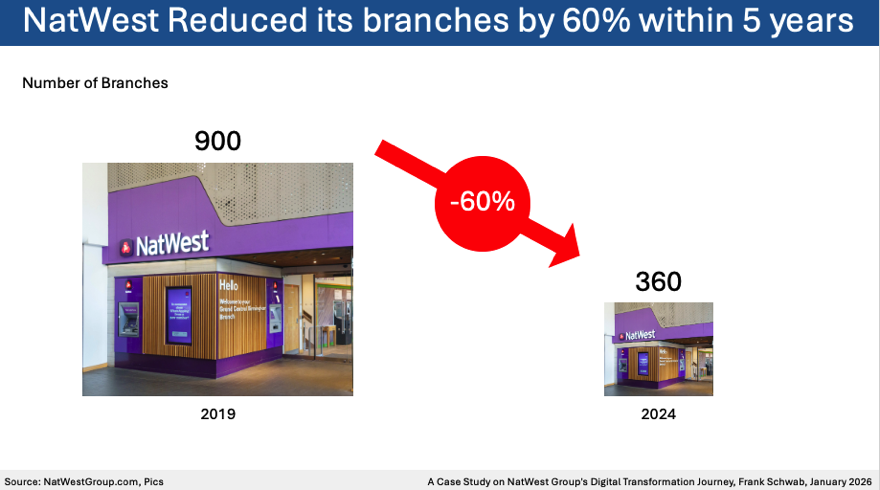

The Hybrid Operating Model

The transformation replaced a branch-centric model with a digital-first operating architecture. Most customer interactions were redesigned to occur through mobile and online channels. Human advisors were reserved for complex and high-value moments. Mobile usage increased significantly as digital experiences improved. By 2024, the majority of retail customers banked exclusively through digital channels. At the same time, the physical branch network was substantially reduced. Social considerations were addressed through partnerships and community initiatives. This hybrid approach balanced efficiency with inclusion. Operational simplicity became a core driver of cost reduction.

From Technical Debt to the Golden Cross

In 2019 and 2020, NatWest’s IT spend was dominated by maintaining aging infrastructure. Innovation was constrained by on-premise systems and high fixed costs. The pandemic reinforced a defensive posture with limited new development. In 2021, the bank committed to large-scale modernization. This triggered a temporary surge in total costs as legacy and cloud systems coexisted. External consultants played a key role in accelerating the transition. The so-called “double bubble” phase tested management discipline. By 2024, new development spending exceeded legacy maintenance for the first time. This “Golden Cross” marked a decisive shift toward future-oriented investment. Cloud, data, and AI became the primary productivity engines.

Financial Validation: Cost-to-Income Ratio and RoTE Improvement

The financial results validated the strategic choices made during the transformation. Income recovered strongly after the pandemic downturn. Profitability rebounded and reached record levels by 2024. Returns on tangible equity nearly doubled compared to pre-transformation levels. Cost efficiency improved as digital adoption reduced operational complexity. Branch rationalization and system consolidation supported these gains. Credit quality remained stable throughout the period. Capital ratios stayed comfortably above regulatory requirements. Productivity per employee increased materially. Financial performance confirmed that digital investment was value-accretive rather than dilutive.

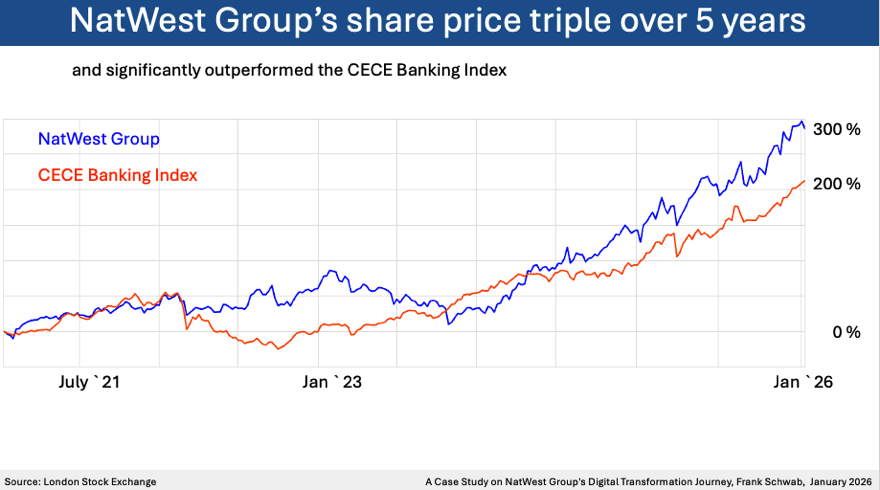

The J-Curve Realized: Share Price Recovery

NatWest’s share price followed a classic J-curve during the transformation. Initial investment and uncertainty depressed valuation during the early years. The pandemic drove the stock to historic lows. From 2021 onward, the market gradually stabilized as earnings recovered. Skepticism persisted while costs remained elevated. Clear proof points emerged once efficiency gains materialized. Full government exit removed a long-standing valuation overhang. Investor confidence strengthened as returns improved. By 2026, the share price reflected normalized profitability. The market ultimately rewarded patience and strategic consistency.

Green Financing and Data-Driven Underwriting

Sustainability was integrated into the digital strategy as a commercial opportunity. NatWest set ambitious targets for climate and sustainable financing. Data-driven tools enabled better risk assessment for green lending. Digital platforms helped customers measure environmental impact. This data fed directly into credit models. By 2024, most of the sustainability target had been achieved. Green finance became a scalable business line. Technology allowed climate objectives to align with profitability. The approach demonstrated how digitalization supports ESG goals.

Risk Management and the “De-Banking” Crisis

The transformation period was not without governance challenges. The Coutts de-banking incident in 2023 created significant reputational risk. Leadership changes followed intense public scrutiny. Despite this, customer behavior remained stable. Deposits continued to grow after the incident. Credit metrics showed no deterioration. The episode tested institutional resilience rather than financial strength. Core systems and controls proved robust. The bank’s operating model absorbed the shock. Risk management capabilities remained intact.consistency.

© Frank Schwab 2026