Frank Schwab

I bridge the gap between Visionary Technology

and Balance Sheet Profitability

Mauritius Commercial Bank’s Digital Transformation Journey

Leading the way with technology, efficiency, and customer focus

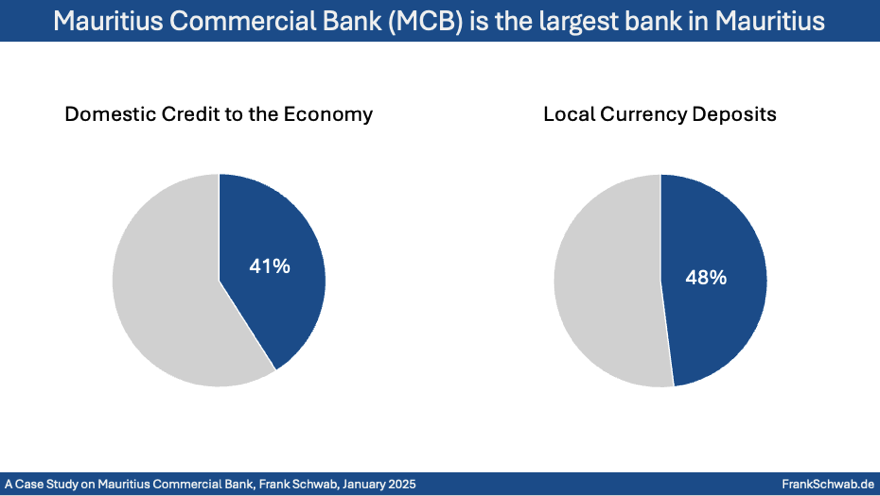

The Mauritius Commercial Bank (MCB) has undergone a significant digital transformation that has positioned it as a leading financial institution both in Mauritius and the region. Established in 1838, MCB is the largest bank in Mauritius, with a balance sheet size of USD 18.4 billion as of 2024 and net profits of USD 330 million. MCB's market share in domestic credit and deposits stands at 41% and 48%, respectively. Its strategic focus on digital channels has led to 85% of retail transactions being processed online, with its mobile app, "MCB Juice," boasting over 500,000 users. MCB's operations span internationally, contributing 63% of its profits in 2023, with expansions into markets like Madagascar, Mozambique, and India. The bank's robust digital infrastructure includes the adoption of Oracle Exadata, reducing batch processing times by 64% and cutting database patching durations by 99%.beyond.

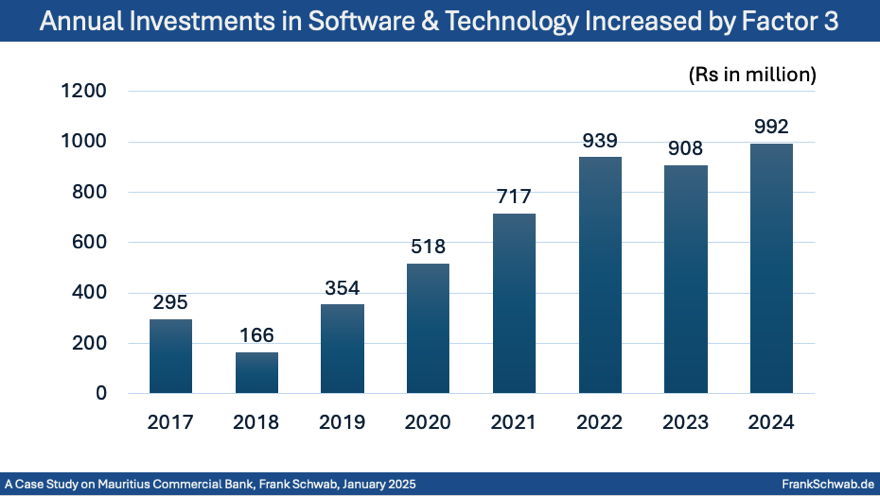

The transformation of the Mauritius Commercial Bank (MCB) represents a significant case study in how a historic financial institution can leverage technology to achieve exponential growth and operational excellence. Established in 1838 as the oldest banking institution south of the Sahara, MCB has evolved into the largest bank in Mauritius, commanding a market share of 41% in domestic credit and 48% in deposits. As of 2024, the bank boasts a balance sheet of USD 18.4 billion and net profits of USD 330 million, underscoring its financial dominance. However, the bank's recent success is not merely a product of its legacy but the result of a deliberate digital strategy that has seen over USD 100 million invested in software and technology since 2017.

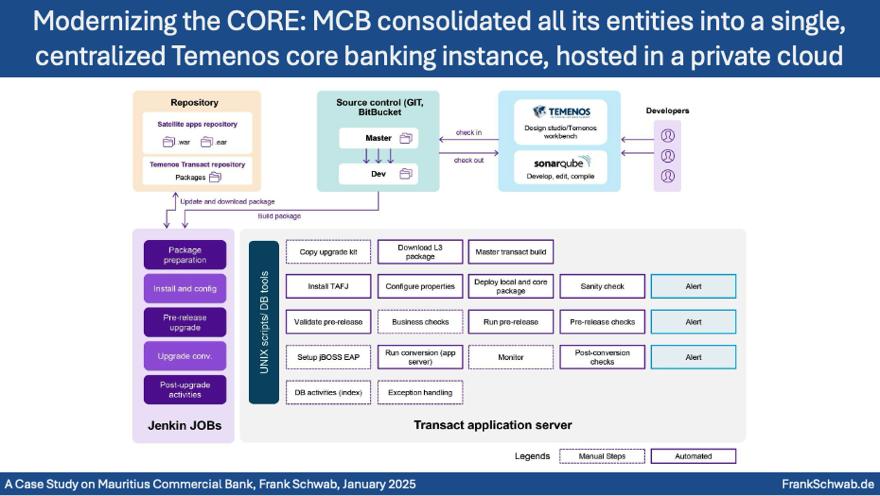

At the core of MCB's modernization was a radical overhaul of its technological infrastructure to address the inefficiencies of legacy systems. The bank migrated its core banking operations to a private cloud architecture, a move that reduced its hardware estate by 70% and cut execution times for annual upgrades by 50%. A pivotal component of this infrastructure upgrade was the adoption of Oracle Exadata, which delivered immediate and quantifiable efficiency gains. The migration slashed daily batch processing times by 64%—from 7 hours to just 2.5 hours—and reduced the time required for database patching by 99%, dropping from months to mere hours. These technical improvements laid the foundation for a more agile organization, capable of deploying new services rapidly.

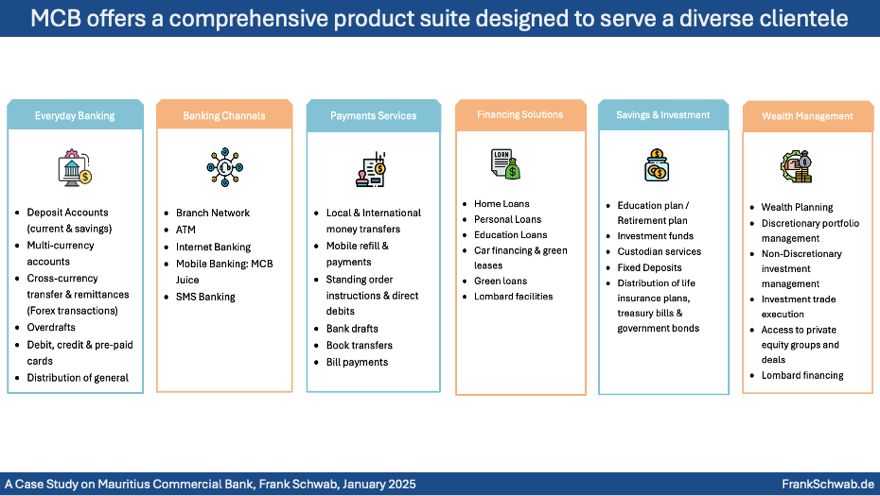

This robust infrastructure enabled MCB to revolutionize its customer-facing products, driving a massive shift toward digital channels. By 2024, 85% of the bank's retail transactions were processed online. The flagship mobile application, "MCB Juice," grew to serve over 500,000 users, facilitating widely adopted features like cardless withdrawals and PayPal integration. For the Small and Medium Enterprise (SME) sector, the bank launched "JuicePro," which gained 24,000 subscribers and achieved a customer satisfaction rate of 78% across 28 feature releases. The impact of these digital tools was tangible; for instance, the "Express Overdraft" feature on JuicePro disbursed more than 300 overdrafts totaling over Rs 140 million in 2023 alone. Similarly, in wealth management, the "Juice Invest" app attracted over 29,000 active portfolios by late 2023, democratizing access to investment tools.

Looking ahead, MCB’s strategy extends beyond digital boundaries into regional expansion and sustainability. The bank’s international operations have become a primary revenue engine, contributing 63% of total profits in 2023, with successful ventures in markets such as Madagascar, Mozambique, and India. Simultaneously, MCB has reinforced its commitment to sustainable banking by issuing a Green Bond valued at USD 60 million in 2023 to finance renewable energy projects. With a Capital Adequacy Ratio of 19.8% and a Return on Equity (RoE) of 19.2% in 2024, Mauritius Commercial Bank stands as a testament to how traditional financial institutions can harness data and technology to secure a prosperous and resilient future.

Case Study (41 pages) 🔗 Mauritius Commercial Bank

#banking #strategy #digital #digtialtransformation #digitaljourney

#casestudy

In the corporate and institutional banking sector, MCB focused on automation and compliance to enhance speed and security. The introduction of "SmartApprove" streamlined corporate transactions, achieving a Straight-Through Processing (STP) rate of 90% and processing over 16,400 transactions without manual intervention. To bolster risk management in its trade finance operations, the bank partnered with Windward to implement AI-powered compliance tools. These innovations contributed to a significant improvement in asset quality, with the bank’s Gross Non-Performing Loan (NPL) ratio declining from 5.9% in 2017 to a healthy 2.8% in 2024, while the Provision Coverage Ratio surged to 74.5%.

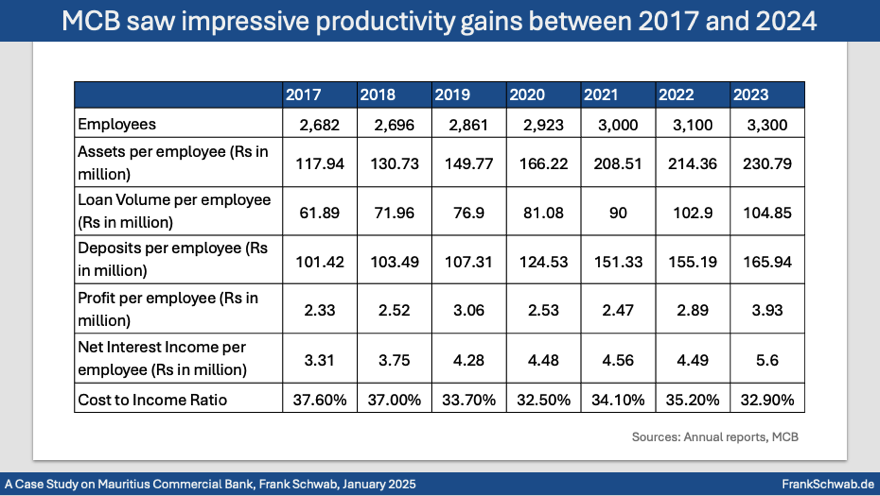

The financial and operational outcomes of this transformation have been profound. Between 2017 and 2024, MCB’s balance sheet grew at a Compound Annual Growth Rate (CAGR) of 15%, while Profit Before Tax (PBT) increased at a CAGR of 14%. The bank achieved this growth while maintaining remarkable operational efficiency; assets per employee nearly doubled during this period, and profit per employee rose by approximately 70%. This efficiency is further reflected in the Cost-to-Income Ratio (CIR), which improved to 33.6% in 2024. Furthermore, the bank maintained a disciplined workforce strategy, expanding its employee base to only 3,300 while retaining a high retention rate of 96%.

© Frank Schwab 2026