Stablecoins are rapidly transforming the financial landscape by providing a stable digital currency, forcing traditional banks to adapt to new technologies and regulatory frameworks. Their increasing use in cross-border transactions and decentralized finance is driving innovation, while also presenting challenges related to risk management and the need for robust digital infrastructure.

The Anchored Tide

The digital age has ushered in a new financial paradigm with the rise of stablecoins. While the volatility of cryptocurrencies like Bitcoin initially captured global attention, a more subtle revolution was underway. Stablecoins, designed to maintain a stable value pegged to traditional assets, are emerging as a powerful megatrend, reshaping finance, commerce, remittances, and humanitarian aid. They represent a fundamental shift in how value is transferred and stored, bridging the gap between volatile cryptocurrencies and the stability of fiat currencies.

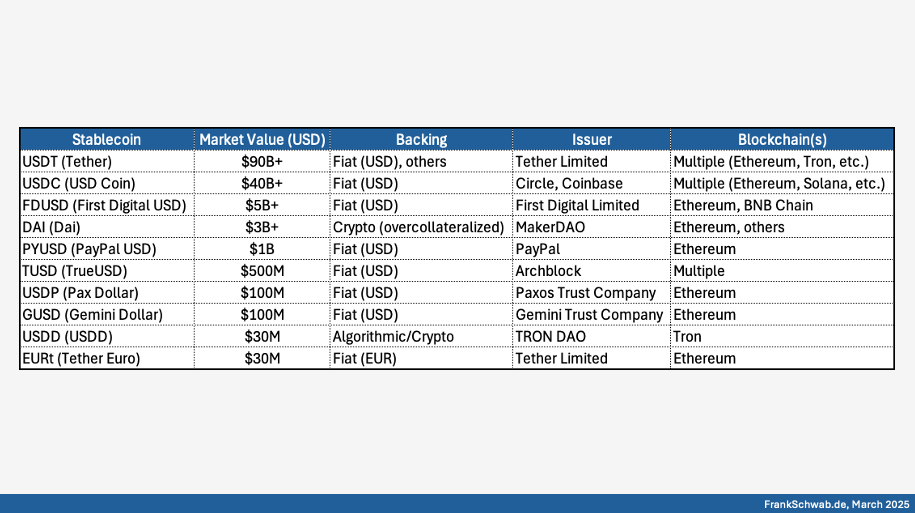

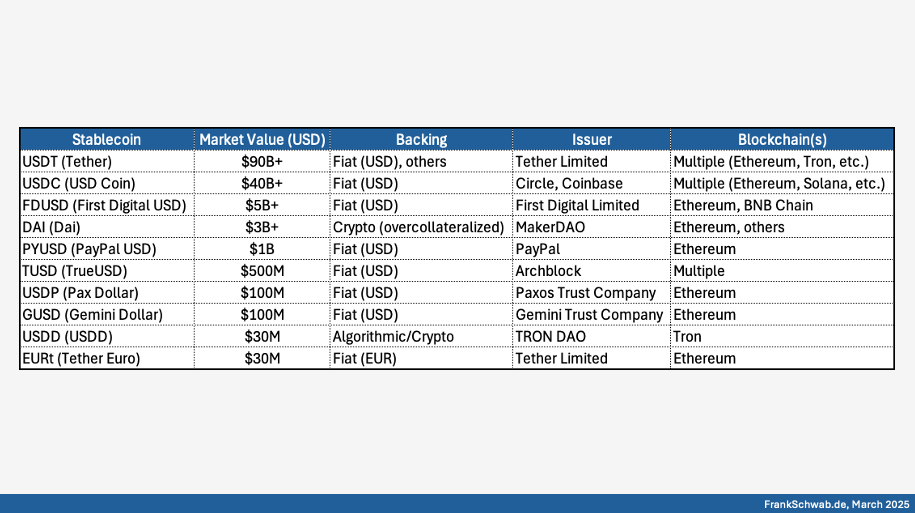

A stablecoin is a cryptocurrency whose value is anchored to another asset, primarily the US dollar, through mechanisms like reserve holdings, algorithmic methods, or cryptocurrency collateral. The appeal lies in combining the speed and borderless nature of cryptocurrencies with the familiar stability of traditional currencies.

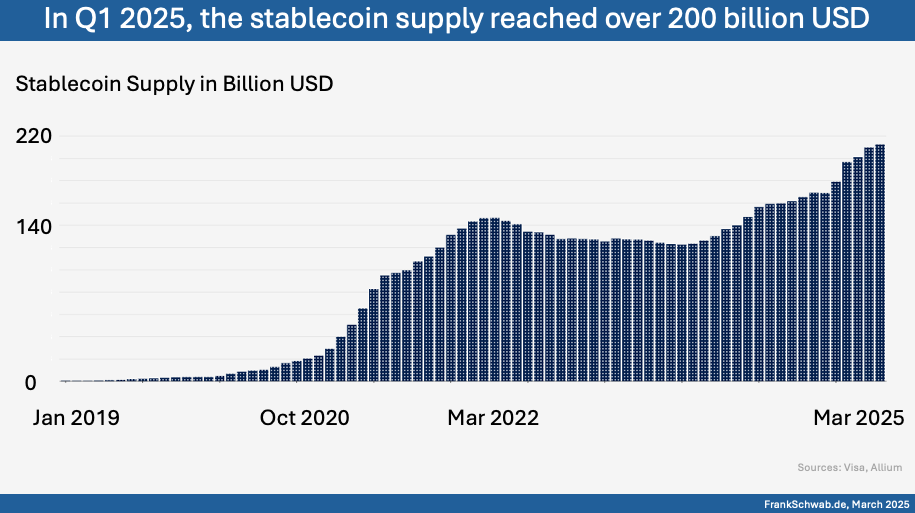

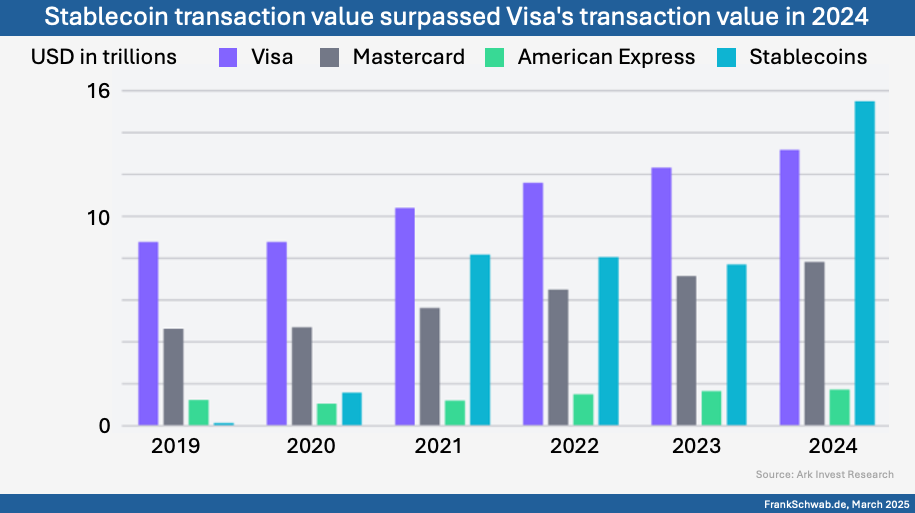

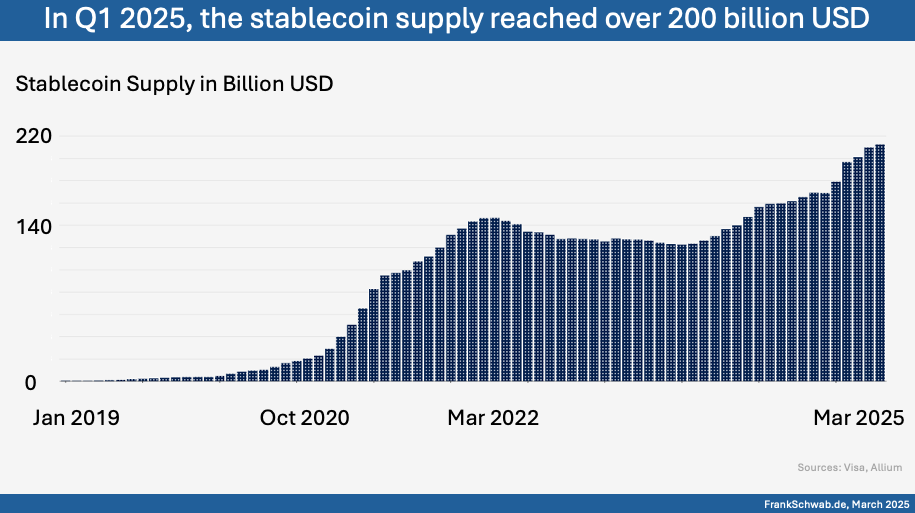

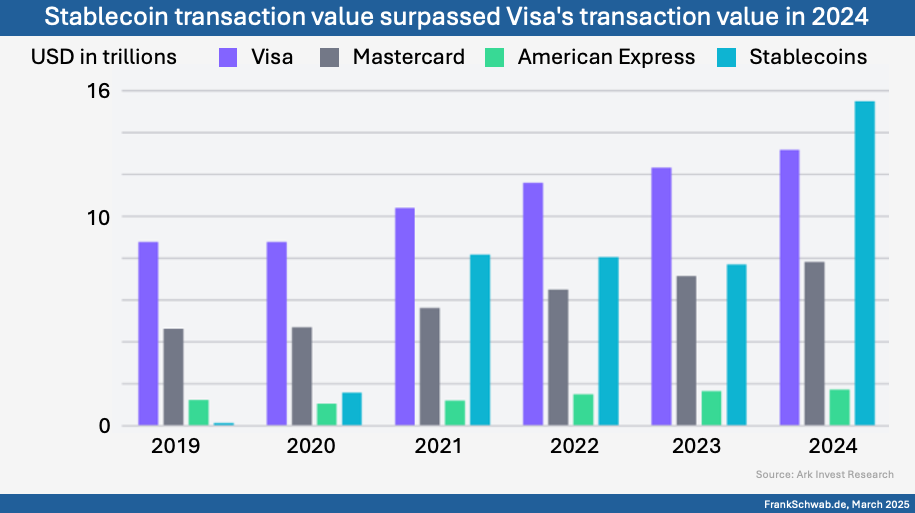

The growth of stablecoins has been substantial, with market capitalization surging from approximately $3 billion in early 2019 to over $200 billion in Q1 2025, and demonstrating resilience even during market downturns. This growth signifies a fundamental shift in value perception and transfer, particularly in regions facing hyperinflation or political instability. In Venezuela, for example, stablecoins have become essential for everyday transactions, protecting savings and facilitating business. Similarly, in Argentina, stablecoin adoption has surged, driven by individuals seeking refuge from economic uncertainty. Beyond individual use, stablecoins are revolutionizing cross-border remittances, offering near-instantaneous, low-cost transfers that bypass traditional intermediaries. This trend is evident in countries like the Philippines, where migrant workers increasingly use stablecoins to send money home, supported by the growing adoption of mobile wallets.

The gig economy also benefits, as freelancers and remote workers receive payments quickly and securely, circumventing traditional banking challenges. Furthermore, stablecoins are streamlining supply chain management and international trade by tokenizing invoices and trade documents, particularly benefiting small and medium-sized enterprises. In humanitarian aid, organizations like the World Food Programme use stablecoins to distribute aid efficiently to vulnerable populations, ensuring rapid delivery and reducing fraud.

The European Union's Markets in Crypto-Assets (MiCA) framework exemplifies the growing regulatory recognition of stablecoins. Like the internet's trajectory, stablecoins are experiencing steady and then explosive growth, driven by their inherent advantages.

The decentralized finance (DeFi) ecosystem, with its reliance on stablecoins for lending and trading, further fuels this adoption. E-commerce, especially cross-border transactions, is being transformed by the near-instantaneous and low-cost payments enabled by stablecoins.

Content creators also benefit, receiving payments quickly and directly, regardless of location. The exploration of central bank digital currencies (CBDCs) contributes to the broader acceptance of digital currencies, paving the way for wider stablecoin adoption.

In essence, the stablecoin megatrend is a fundamental shift in value perception and transfer, with its transformative potential evident across commerce, remittances, humanitarian aid, and beyond.

Stablecoins' Impact on Bank Operations

The impact of stablecoins on traditional banking is multifaceted, challenging established models and creating new opportunities. The long-term trend of declining branch usage, coupled with the rise of digital banking, has paved the way for the acceptance of stablecoins. Banks with robust digital infrastructure are better positioned to integrate stablecoin services.

The Bank for International Settlements (BIS) has conducted extensive research on the implications of digital currencies, highlighting both the risks and benefits of stablecoins. While concerns about systemic risk and bank disintermediation exist, the potential for improved payment efficiency and financial inclusion is also acknowledged. Early adopters like Signature Bank, despite its collapse, demonstrated the potential of blockchain technology and stablecoin-related services. The growing trend of banks offering digital asset custody services, exemplified by institutions like BNY Mellon and State Street, indicates a significant revenue opportunity. Traditional correspondent banking faces increasing competition from stablecoins, which offer the potential to reduce cross-border payment costs.

The growth of decentralized finance (DeFi) presents both challenges and opportunities, with banks exploring partnerships to offer stablecoin lending and borrowing. Central banks and financial regulators worldwide are actively exploring the potential risks and benefits of stablecoins, with the pace of regulatory change significantly impacting adoption. A regional bank's pilot program offering stablecoin-based loans to small businesses illustrates the potential for banks to leverage stablecoins for innovative financial products. The impact of stablecoins on banking is evolving, with banks facing both challenges and opportunities as they navigate this new landscape. The potential for disintermediation, the need to adapt to changing customer needs, and the evolving regulatory environment are all factors shaping the future of banking. Banks that embrace innovation and adapt to the changing landscape are more likely to thrive in the age of stablecoins.

Stablecoins and the Next 20 Years

Looking ahead, stablecoins are poised to fundamentally reshape the banking industry over the next 20 years. The convergence of blockchain technology, digital assets, and evolving consumer demands will drive a transformation that necessitates innovation. By 2040, stablecoins could be a standard payment option, particularly for cross-border transactions and e-commerce, forcing banks to adapt their payment infrastructure. The trend towards real-time settlement will accelerate, with stablecoins enabling near-instantaneous transactions and prompting banks to invest in blockchain technology. Stablecoin-based lending and borrowing platforms will emerge, leveraging

the transparency and efficiency of blockchain technology.

The future of banking will also see a shift towards programmable money, with stablecoins enabling the creation of smart contracts that automate financial transactions. The development of central bank digital currencies (CBDCs) will accelerate the adoption of digital currencies, creating a conducive environment for stablecoin adoption. Embedded finance, facilitated by stablecoins, will integrate financial services into non-financial platforms, expanding access and generating new revenue streams. The regulatory landscape will continue to evolve, with regulators developing comprehensive frameworks for stablecoins. By 2035, a significant portion of wholesale interbank settlements could be conducted using stablecoins, transforming treasury operations.

Stablecoins have the potential to accelerate financial inclusion, particularly in developing economies, bringing billions into the formal financial system. The digitalization of trade finance, driven by stablecoins and blockchain technology, will streamline processes and unlock new trade flows. The remittance market will be transformed, with stablecoins significantly reducing fees and speeding up transfer times. The growth of the digital asset market will create new opportunities for banks to offer custody, trading, and lending services. Corporate treasury management will see cost reductions through stablecoin adoption, and the insurance industry will benefit from reduced fraud.

The metaverse and virtual economies will create new opportunities for stablecoins, and supply chain finance will be streamlined through blockchain integration. The impact of stablecoins on the future of banking will be transformative, with banks that embrace innovation and adapt to the changing landscape thriving in the digital age.

Adapting to the Anchored Tide: Banks' Action Plan

The trajectory of stablecoin adoption necessitates a proactive and strategic response from the banking sector.

Banks must prioritize the development of robust digital infrastructure, investing in blockchain technology and secure digital asset custody solutions. Proactive regulatory engagement is crucial, with banks participating in shaping regulatory frameworks. Banks should explore the development of stablecoin-based products and services, leveraging stablecoins in payments, lending, and trade finance. Investing in workforce education about digital assets and blockchain technology is essential, as is exploring partnerships with stablecoin issuers.

Cybersecurity and risk management must be prioritized, with robust security measures implemented to protect customer assets. Banks should explore the potential of decentralized finance (DeFi), engaging with the ecosystem to identify innovation opportunities. Preparing for the coexistence of CBDCs and stablecoins is crucial, with banks developing strategies to integrate both into their operations. Actively monitoring the competitive landscape and adopting a customer-centric approach to innovation are also essential. Banks must understand evolving customer needs and develop stablecoin-based solutions that address those needs. By embracing these strategies, banks can prepare for the future of stablecoins, ensuring they remain at the forefront of the evolving financial ecosystem. The transition will be challenging, but those that adapt and innovate will thrive.

#megatrends #stablecoin #banking #crypto #cbdc

http://www.FrankSchwab.de